Market Conditions: When Will New Construction Begin Again?

The Chicago Tribune recently had an article about the price cuts at downtown developments such as Parkside of Old Town (which we chattered about already here at Crib Chatter) and The Columbian, the highrise along Grant Park on Michigan Avenue in the South Loop.

But once we make it through this round of price cuts and sales, then what?

There is little new construction anywhere in the city (without counting conversions- of which some of those are still ongoing.)

Appraisal Research Counselors predicts that it will be at least two years and maybe more than three years before new development deals begin. In fact, the only project scheduled to deliver condos to the market in 2011 is the ultra-high-end Ritz Carlton Residences.

“This is a strategy that developers contemplate,” said Gail Lissner, a vice president at Appraisal Research Counselors. “They fully realize that there is going to be no more new product added to the market and next year we’ll have fewer units that are in competition.”

Adds Schultz of @Properties: “Everyone wants to hold out as long as they can.”

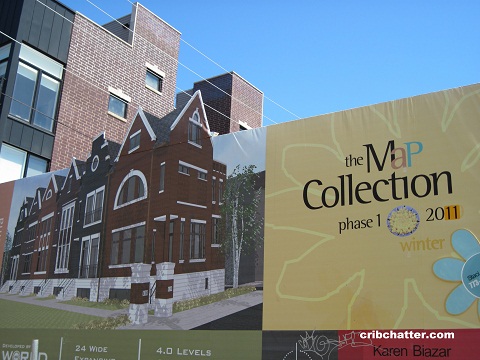

A few months ago I was walking on the 800 block of North Paulina in West Town and noticed this vacant lot and a sign for the townhouse development.

You can see from the pictures that the year of completion keeps getting changed and now says 2011.

When will the market be healthy again for new construction to start?

Price cuts mount as condos linger [Chicago Tribune, Mary Ellen Podmolik, July 4, 2010]

Anyone know whether the building (beyond the parking garage) is ever going to be built at 2520 N. Lakeview?

My predicition is that it will be at least several years (over 5 -10 years) before any new construction begins. Remember, a HUGE percentage of the new construction in the late 90s and early 2000s was driven by investors. All of these investors are probably “out” of the market for the rest of their lives (after being burned so badly). In addition, the inventory is still huge.

However, all of that being said, we are a spoiled bunch of people and love new construction – so there probably will be a few select areas and buildings (like the Ritz) that may be very profitable- but these will be few and far between.

New const will be very limited through the next 3 years. After then, it all depends on the econ. There are several building proposals but everything is still on hiadus for financial reasons, obvi.

Rumor has it that the spire should be completed by the end of the year (jk).

I think ARC has it about right. They pretty closely track the existing new development inventory and how quickly it is being worked through. However, no telling what these developers are planning. There is a huge ego component to what they do. You hear about Lake View Station planning on breaking ground this year in Uptown. Of course, condos are only part of the plan.

BTW, we’re seeing months of supply of condo inventory rising for the first time in several months. Contract activity has really fallen off since the tax credit expired.

I think new development will unfortunately come before we all need it for two reasons. 1) Government cannot say no a higher tax values that come through developoment of vacant sites even if the community does not need it. 2) Developers have business infrastructures (admin, project managers, etc) that they cannot pay for 2-3 years to sit idle. They need to do something or close.

2020 before any meaningful construction begins. We are in areal estate depression that’s going to linger for a decade. Watch for new home sales to crater again to a new low later this year. I say this over and over again: its the pricing syoopid! Todays new construction deals aren’t even deals by historical standards. Lower prices equals more sales.

Not a big deal, but just to correct Sabrina’s post, that “Map Collection” is actually at 800 North (not South) Paulina. I walk by it all the time, and was also amused to see the “2011” slapped over the original date.

You’re right- it’s 800 NORTH. My bad!

There will be no large scale developments in Chicago for some time. Local lenders are not going to finance construction in this market and national lenders do not have confidence in Chicago. Some foreign lenders have stepped back into the condo market on a select basis in NYC… but that is NYC where they still get $1,400/SF and the loan basis is $500/SF. 2520 Lakeview has been shopped around for over 4 years and even at 50% LTV, I don’t know of anyone who is going to finance it.

Assume for a second that a bank WILL front $$$ for new construction, it will be at least 2+ years before anything is delivered.

There won’t be any new development any time soon until there is an inventory shortage to get supply back in line with demand. They can barely sell out what is existing much less new projects. No one is going to take on large scale development in this market – banks aren’t going to finance new developments nor are they wanting to finance buyers of new construction.

New construction was fueled in large part by a lack of inventory in many markets initially and then easy financing of both builder and buyer. Neither of these situations is likely to exist for a while.

It very well could be 10 years before there is any appreciable new construction.

I think new construction will occur sooner than people think.

Prices on existing stuff is way too slow to come down to reality, especially with so many people being underwater. At some point in the near future, the advantages of being able to set reasonable prices up front will outweigh all of the hassles with new construction.

Existing owners cannot fathom how much worse it is going to get. But it will.

If new construction doesn’t start within two years or so we’re going to have a housing shortage!

“However, no telling what these developers are planning. There is a huge ego component to what they do.”

The massive egos of developers (actually every one in every step of the industry) has been eliminated after learning a harsh lesson from the burst. Egos are slowly being replaced with a new sense of humility and common sense. ‘Dream projects’ by starchitects are now a thing of the past and they will be the last bracket that will return somewhere far down the road, but it will not be at all similar of the projects of the past.

The one good thing that has emerged over the past two years, has been the much needed thinning of the herd. Only the ‘top, successful no matter what’ people will be around to go forward with future developments. Those with less than stellar success have gone into other industries after losing their company and personal reputation.

The same holds true every step along the way… renovators, material suppliers, designers, RE brokers/agents, mortgage companies, banks, etc. Every component of this Industry has lost the poor or fraudulent performers…for now.

It is now up to the Governement… local, state and Federal to grow a huge pair and implement strict regluation of the Industry in order to regain the confidence from buyers and investors. Without the most demanding and stigent regulations, I am afraid the same disaster will emerge again a few years down the line.

And of course we all know who we have to thank for deregulation in most every industry….yep ole W. His approach was always f**k the consumer, I am going to make sure the only money to be made will be there for those who always have had the money. Rich getting richer on the backs of the hardworking middle class.

There will be a rebirth of new developments but it will not be the upper end luxury projects of the past. Pricing will be more affordable and obtainable for the blue collar, lower to middle income first time buyer group. Hopefully they will realize that these new buyers will be approaching the situation in a whole new way…by being more educated and realizing exactly what they are able to afford. Allowing this group to successfully reenter the market will motivate the more experienced buyers to take the next stepcurrent into the over supply of upscale luxury developments.

While it is easy to point the finger of blame exclusively at developers and builders, we all have to remember they only furnished the end product for public consumption and were not at all responsible for pushing through unqualified and uneducated buyers.

Sonies,

Snark aside, builders don’t care about an oversupply of houses. If a reasonable price for a condo in 2012 is $250,000 and they can build it for $200,000 they will build it knowing full well that all of the existing owners will still be asking $350,000-$400,000 and will need to go begging to the bank for a short sale @ $250,000.

The buyer will have a choice. No hassle new construction or wait 6 months for an answer on whether or not the existing condo can be sold or not. I know what I would choose.

The technical term is “F the existing houses; not my problem.”

A housing shortage would be a benefit to Chicago given that shortages typically increase pricing as stated by supply/demand. The issue is that the currently available inventory is a)not that great (cookie cutters, location, etc) and b)still overpriced. This will only benefit current owners since there will be a lack of new const in the next few years.

The really ironic part is the split between people who think it’s going to get soo much worse (OMG THE SKY IS FALLING) vs. those who are snagging deals on REO’s and current owners who aren’t underwater.

Everything is cyclic. Housing will rebound. Recession = recess is on for the wise and saavy investor.

“…Some foreign lenders have stepped back into the condo market on a select basis in NYC…”

Not only is this true in NYC, but it is also showing up in other delapidated markets such as Miami and Vegas. There are some incredible deals to be had in Miami, but it will be years before these foreigners will be able to flip their ‘great deal properties’. Buildings who promised never to go rental have abandoned that policy and now lower income individuals are able to experience what it is like to live in those amazing glass towers…once the exclusive territory of the uber wealthy.

“Existing owners cannot fathom how much worse it is going to get. But it will.”

I don’t think that once popular doom and gloom outlook has much merit…sure prices for new buildings will drop more, but not that much more.

I still don’t understand why people don’t understand psychology!!!!

If the stock market continues to improve and people feel as though they are doing better financially, they WILL start buying houses. Many people are unhappy with their living situation and have been out of the market because of all of the uncertainty. However, once they get a sign/chance, they WILL start buying again (falsely thinking that their lives are going to improve). Very few people take a logical approach to their homes/houses/living situatiuon. It is so much more psychological than people realize (especially the very logical people who post on this site).

Tipster I am not sure where you will be getting the land, raw materials and labor to cut those rates but great job if you can. None of these items have repriced enough to see that kind of saving. With the ever increasing construction codes in size and cost as well as premium locaitons will always demand premium prices. You might be able to save 20% in the South Loop the next development being cheaper or as cheap as the last was always an issue down there.

“I don’t think that once popular doom and gloom outlook has much merit…sure prices for new buildings will drop more, but not that much more.”

There’s a floor to construction costs. But there’s still plenty of room for land prices to drop in most more desirable locations, not that I am predicting that. So there’s room for prices on new construction to go lower, w/o hurting developers ROI.

For those of you saying new construction will start sooner than later, where exactly is this new construction going to go? Chicago isn’t Plainfield where we have a ton of empty cornfields to build on.

Most of the desirable land for large projects has already been developed. I seriously doubt anyone is going to try pushing the boundaries of the far south loop or far west loop any time soon considering they can’t even sell half the units in more desirable locations.

Most of the buildings that could have been converted have been already as well.

There is simply too much supply relative to the cost and availability of buyer financing in Chicago – particularly with high rises. We won’t see a run up again until supply is exhausted which could be many many years from now. There will always be people moving and buying but I am not expecting the full on frenzy of the past 10 years.

Its more than market psychology. Its good credit, sufficient income and a down payment. Which is in short supply this recession. Open the floodgates to 560 ficos with zero down and you’ll reignite the market. All those recently foreclosed fb’s can’t wait tp buy again and snag a deal on an REO!

Secondly, there aren’t very many REO deals out there in areas where people like us want to live. Its all shadow inventory at this point. And there is a lot tied up in pre-foreclosure and HAMP. Millions of properties.

“Secondly, there aren’t very many REO deals out there in areas where people like us want to live”

thats why prices have remained more stable in desireable neighborhoods and why you probably shouldn’t buy in a crap neighborhood unless you get a super deal

There are some infill SFHs being built selectively around Lake View. I always wonder who is buying them.

This project has also shown life in the last few weeks as the units were listed.

http://www.row2750.com/

“…you probably shouldn’t buy in a crap neighborhood unless you get a super deal”

Forget the super deal properties at this point of the game. It is certainly NOT a good idea as delapidated hoods will not be undergoing any type of transformation other than worsening for years to come.

Having the best house (DIY project) on a crappy hood nowadays mean exactly that and no more…sure at one point in the recent past this was definately the way to go, not any longer.

I have risked a good share of my $$$ on this approach in the past. Luckily I learned quickly this is NOT a good idea as 80% of areas in serious need of regent will never get it.

My belief is to find a unit in a decent to good hood….a place that needs a minimal amount of work such as updating, combining smaller rooms into larger spaces, rearranging areas so every foot..every inch is usable.

My advice to buyers at this time? Buy what you can afford in a good area, one which you don’t have to keep telling yourself it WILL improve. Once you do the work yourself with a decent budget, enjoy it and plan on staying put for,at the very minimum, the next 10 years.

There will some new construction as land prices fall. If someone built a house (hard costs) for $350K, and the lot was $400K, and it was once worth $900K…..then what’s going to stop someone from buying a lot today for $199K and putting a $300K house on top of it? They are all in, new construction, with their own floor plan/finishes etc. for $500K.

I can see this happening as long as lot prices fall. There might even be some spectacular low prices of REO shacks which can be knockdowns for lot value in the near future?

“There might even be some spectacular low prices of REO shacks which can be knockdowns for lot value in the near future?”

Not too many of those left in the desirable spots. Some, definitely, but many, many fewer than 15 years ago.

Prices have dropped so precipitously on existing units, that new construction can’t really compete. Until the inventory gets soaked up (no pinning hopes on a pipe dream like The Olympics), I don’t see anyone funding new construction. Banks and pension funds have all been burned badly by high-rise real estate investments.

But at some point, many of the 1950s crap high-rises along the lakefront, from Lakeview to Edgewater, will need to be torn down. There is an expiration date on a lot of Chicago buildings. Some of them you just can’t renovate the ugly away.

Good luck building a SFH in Chicago with the finshes and floor plan you want for $300,000. As for lots/teardowns for $199k in decent areas, I haven’t seen that yet. But yes, if people could get a new, custom house in the green zone for $500k, they would be doing that.

You can buy a house in Garfield Park for like 2k

I sometimes wonder if a near death experience is worth having no mortgage

if the ritz carlton counts, isn’t there new construction going on right now?

i agree with Tipster. as long as there is a margin, new houses will get built even if it doesn’t make sense. i’ve heard stories that las vegas construction has resumed because people can’t find the “right” houses (don’t want to endure foreclosures process, people like new houses).

“i’ve heard stories that las vegas construction has resumed because people can’t find the “right” houses (don’t want to endure foreclosures process, people like new houses).”

And the builders have a, post-BK or loan restructuring or whatever, much lower cost-basis for the land they are building on. Imagine (there are examples, but I don’t have them handy) a builder who bought 100 acres in the desert in 2005, did all of the infrastructure work, went BK in 2009, the lender took back the land and sold it for 50% (or 30% or 80%) of the loan amount, which was only 70% of the builder’s cost–instead of, say, $100k per lot, the new builder has $40k per lot costs. And more people willing to work for slightly less money and (maybe) slightly cheaper material costs. And a *much* more accommodating permitting process (since they’re just happy something is happening). Probably could shave $75k off a typical 2000 SF Vegas house.

I’m sure there is some construction going on but that doesn’t jive with stats that say new housing starts are just off mulit-generational lows.

http://calculatedriskimages.blogspot.com/2010/06/housing-starts-may-2010.html

“GLS on July 13th, 2010 at 11:18 am

i agree with Tipster. as long as there is a margin, new houses will get built even if it doesn’t make sense. i’ve heard stories that las vegas construction has resumed because people can’t find the “right” houses (don’t want to endure foreclosures process, people like new houses).”

“I’m sure there is some construction going on but that doesn’t jive with stats that say new housing starts are just off mulit-generational lows.”

jibe. jive is something else.

almost 500k annual starts, seasonally adjusted, means there were 30-60k (not sure how the adjustment works for May) houses where permits were issued in May. That’s not a lot, but they must be being built somewhere.

Russ: you said contract activity has really fallen off a cliff since the expiration of the tax credit (and I predicted it would)….but how come when I search on Redfin for homes with price reductions in the last 30 days (no matter how nominal the reduction), barely any homes show up on my screen? It makes no sense. There is barely any contract activity yet no sellers want to lower their priced…meanwhile, like you state above – inventory is building….

this scenario sounds sooooo much like late 2007 and early 2008….I think prices are about to fall off another cliff.

if the market isn’t doing well now, it ain’t coming back before the end of the year w/o significant price reductions.

“BTW, we’re seeing months of supply of condo inventory rising for the first time in several months. Contract activity has really fallen off since the tax credit expired.”

Typo – v is next to b on qwerty

“jibe. jive is something else.”

America is a big place, with 50 states, nearly 300,000,000 people…30k-60k starts is very very low. A house here, a house there…

“almost 500k annual starts, seasonally adjusted, means there were 30-60k (not sure how the adjustment works for May) houses where permits were issued in May. That’s not a lot, but they must be being built somewhere.”

There is always going to be small spec builders doing infills and walk up conversions. However, it is going to be awhile before we start seeing new mid and high rises. First, there isn’t anywhere desirable to build them left and there is a glut of inventory of existing units to compete with.

HD, I think that was Gary’s quote.

Home prices are sticky and many people are not going to cut their prices and try to hold out as long as possible. Most people don’t want to accept that their home is worth less. While the rational decision might be to just sell and get the hell out of dodge, most people aren’t rational when it comes to real estate.

Homedelete,

Actually, that was me you quoted. I think sellers are in a bit of a state of shock right now and haven’t yet adjusted. Also, they may have been expecting the June peak to save them but that peak happened in April this year. It’s entirely possible that pricing could collapse in the next couple of months as sellers start to race for the exits before the season is over. BTW, I’m only speaking in terms of the mid to lower tier of the market where the tax credit had its pseudo impact.

“how come when I search on Redfin for homes with price reductions in the last 30 days (no matter how nominal the reduction), barely any homes show up on my screen? It makes no sense. There is barely any contract activity yet no sellers want to lower their priced…meanwhile, like you state above – inventory is building….”

Thank you Gary and thank you Russ.

“Typo – v is next to b on qwerty”

figured, but it’s a common misuse (and a peeve), so wasn’t sure.

“A house here, a house there”

C’mon. Of course the construction isn’t at ’06 levels *anywhere* but it’s not like what construction is happening is evenly distributed. That LV has new houses being built is testament to how underwater most owners of new-ish homes in LV are–the builders can make money building new, probably including by selling to walkaways from their own prior developments.

How much does an AVERAGE Green Zone house cost to construct? hard costs alone?

This is something I’ve always wondered about, can you build for $150K per sf or less and have average/adequate finishes?

any builders know?

What is the average SF calc for a two-story house on a 25×125 lot with 3 bds. upstairs and 1-2 in the finished basement, with a small yard (meaning house doesn’t totally max out the lot)? 1,800 sf per floor right

“Good luck building a SFH in Chicago with the finshes and floor plan you want for $300,000.”

typo: can you build for $150 per sf?

Can u cc veterans define “green zone” boundary for a newbie like me?

Dan the problem is that the land is supposed to be 1/3 to 1/4 of the final selling price of the final structure (whether 3flat or SFH). During the boom the builders were buying teardowns for $450k $550k in the green zone and much much higher in lincoln park, etc. So like that realtor said today in an earlier thread, his clients are looking to pay $550k for ‘the dirt’ IIRC in the sourthpart area which means the final structure will be at least 1.5 million. So, Even if you get land in the green zone for 550k it’s going to be $300,000 at $150 a sq ft for a 2,000 foot house which comes to around $800k for your house. Not cheap.

usually land is the first thing to drop in value during a real estate bust. However, on the northside there isn’t much vacant land, there are only teardowns. However, most of the teardowns are priced either the same price as turhkey homes, or, just high enough for a flipper to put some lipstick on a pig and make $50k or $60k. Accordingly, land prices (aka tear downs) won’t drop until the rehabbers get busted out and they can’t flip anymore.

JC:

the most popular gentrified neighborhoods…

Lincoln Park, Lakeview, Wrigleyville, Southport, BUcktown, Roscoe Village, West Loop, South Loop, Gold Cost, Andersonville, Lincoln Square, etc.

Basically the places that young yuppies typically will live and buy real estate.

I would say North boundry is Ridgeland, West Boundary is Western, South Boundary is probably 14th street or so. Not too familiar with the streets in South Loop, just know it when cross the tracks so to speak.

“What is the average SF calc for a two-story house on a 25×125 lot with 3 bds. upstairs and 1-2 in the finished basement, with a small yard (meaning house doesn’t totally max out the lot)? 1,800 sf per floor right”

w/o any variances/special circumstances, you basic house on a 25×125, in RS-3 (most of the areas we discuss) needs: side setback totaling 5′, and has a max FAR of .9, so max above-ground SF of ~2800. At 1400/floor, that’s still about a 70′ deep house, which, with a normal front setback, doesn’t leave much yard in front of the garage. 4200 total interior space w/ the basement.

Consensus from the times I’ve asked here is that $150psf is about the floor for construction with nice, but not mls-listing-worthy type finishes. Basically assuming that you have no major issues with construction and don’t spec out all high end stuff. Somewhat less if you’re acting as your own general. So, $630k for construction, and you want to pay less than 1/2 that for a lot–so you’re still basically at $1mm, and there aren’t many teardowns around (anywhere you want to live) for under $350k.

btw–do we have two “Dan”s?

25×125 LOTS ON THE NORTHSIDE FOR $100,000

http://www.redfin.com/IL/Chicago/4310-N-Kimball-Ave-60618/home/13484253

This will be under contract in less than a week.

Yes it’s on a main street and yes albany park is an off neighborhood….but when’s the last time you saw a tear down anywhere on the northside for $100k???

Here’s another one!!!! 25×125 LOT ON A SIDE STREET FOR THE ROCK BOTTOM PRICE OF $49,995. LISTED FOR 7 DAYS AND STILL NOT UNDER CONTRACT!

http://www.redfin.com/IL/Chicago/3342-W-Belle-Plaine-Ave-60618/home/13483100

I’d like to see the meth disclosures on those places. Lol.

HD–“[disasters in poor locations]”

For $299, there’s a house across the river actually in livable condition, also on a side street. Not an ideal spot, but much, much better than either of those:

http://www.redfin.com/IL/Chicago/3619-N-Campbell-Ave-60618/home/13453136

I’d rather buy the crapshacks, tear them down and build a nice 1800 sq ft home with an unfinsihed basement from scratch for $150k a sq ft than pay $300k to live in that crapshack you pointed out. of course this is all academic beacuse none of us would live there but it just goes to show that land is getting cheap right out of the green zone. cheaper land is creeping in to the green zone. There’s just no way land in southport or west lake view will continue to command $550k for a tear down when land not too far away is getting into the $50’s. Albany park might be dangerous but it’s not pullman and land in the green zone will get cheaper. I didn’t say cheap as is $50k for a lot in lincoln park but I wouldn’t be surprised to see lots in the $200,000’s at some point before 2015

“anon (tfo) on July 13th, 2010 at 2:56 pm

HD–”[disasters in poor locations]”

For $299, there’s a house across the river actually in livable condition, also on a side street. Not an ideal spot, but much, much better than either of those:

http://www.redfin.com/IL/Chicago/3619-N-Campbell-Ave-60618/home/13453136“

Sorry, after re reading my posts, i meant $200k lots in west lakeview or other areas like logan, uk, west town, NOT lincoln Park. I didn’t mean for it to read that way. in fact lots are approaching $200k in old irving…

http://www.redfin.com/IL/Chicago/4100-N-Kolmar-Ave-60641/home/13480722

“in fact lots are approaching $200k in old irving…”

Totally livable house in the current condition. Implies a land value of under $150k–I’d argue for $100k lot value on that one, which still values the structure at under $100psf.

Slightly short lot, but $369k for a bona fide vacant lot in WLV, right now:

http://www.redfin.com/IL/Chicago/3831-N-Ravenswood-Ave-60613/home/18662790

Wow anon, nice find. And it’s been on the market for over 6 months too. I’d say it’s still priced too high at $369,000. Why in the world did that realtor say his clients would pay $550 for the dirt?

“Why in the world did that realtor say his clients would pay $550 for the dirt?”

East of ashland is much more expensive. 2 lots on wayne listed for $600 and $619.

Check out 2053 Fremont. $2.7mm for an l-shaped double lot (standard lot + half of an adjacent double lot).

the lot on fremont is absurd. That land might be worth that kind of money if it were closer to downtown. ain’t going to happen.

Given the number of vacant housing units in America and the fact that we have 18.88MM housing units available in the US and the current economic situation I don’t think new construction needs to return to boom or normal levels any time soon. In fact the less new construction the better in terms of stabilizing the housing market.

New construction should downsize to a niche business where the few buyers that want it are willing to pay for the premium of a new home.

“18.88 million of 130.58 million housing units were vacant. This is 14.5% of total housing units.”

http://www.mortgagenewsdaily.com/02022010_census_bureau_130_6_million_housing_units_in_the_us_18_9_million_are_vacant.asp

““18.88 million of 130.58 million housing units were vacant. This is 14.5% of total housing units.””

And 4.626mm of those are “seasonal” houses. And a similar number are rental units and 7,688,000 are “other” which includes second homes and units in reno and the f/c pipeline and whatnot. Dude’s trying too hard to make a negative situation look worse.

here’s what I am talking about: http://www.redfin.com/IL/Chicago/3553-N-Marshfield-Ave-60657/home/13386512

what happens when we really start dealing with crapshack REOs and foreclosures? Will these types of places get dumped on the market for $199K at some point? Maybe the banks don’t think outside the box and are looking past that these are really land sites?

“Most people don’t want to accept that their home is worth less. While the rational decision might be to just sell and get the hell out of dodge, most people aren’t rational when it comes to real estate.”

I can’t even tell you how many of these conversations I have with people. Even when you show them the comps in the building they still believe there is something special about their condo that is worth $50k or $100k more than the other unit! And that theirs will sell for more. (It never does.)

“Will these types of places get dumped on the market for $199K at some point?”

LOL! Dan if that property ever comes down to 199k I’ll buy it for 220k.

There aren’t too many of “these places” in most of the on the beaten path ‘hoods if you’re talking about SFHs.

Not to portray myself as an optimist but I remember back to some RE bull’s strawman argument that everyone (housing bears) on here was waiting to get an SFH in LV for 200k and it wasn’t going to happen. I think it was Steve Heitman or Westloopelo in a rant. While not optimistic on RE overall I rather agree with that statement.

Crapshacks and REOs in other neighborhoods will have a lesser impact as their property value’s tend to already be lower in comparison. But some hoods that gentrified too quickly I see getting decimated by foreclosures.

yeah, but what about a place built IN THE FUTURE??!?

This one was built in 2012. That’s gotta be worth a premium.

http://www.redfin.com/IL/Chicago/1330-W-Monroe-St-60607/unit-216/home/12712821

“here’s what I am talking about: [3553 Marshfield]”

Total crap location within the ‘hood. Looks like it has a 5.5’ basement. Still, if the foundation is in good shape and the mechanicals have been updated since the 60s (unlike the kitchen–doubtful, sure), currently a good deal for someone handy and willing like Groove. Sells for $325k+, easily. I say contract at $345k, after their next price drop.

“but when’s the last time you saw a tear down anywhere on the northside for $100k???”

no joke, a place on the corner of Wellington and Kimball was foreclosed on by the bank, who snapped it up for $35K & then tore it down (it was a condemned coach house). That’s correct – THIRTY FIVE K. The house was in such poor condition it would have almost blown over, so I can’t believe the demo cost much. The lot is 2 blocks from the Belmont blue line and 90/94, I have no idea why it’s just sitting there.

pardon me, Christiana & Wellington, that’s maybe 1/16 of a mile east of Kimball.

Cheap lots are coming in good locations.

“Cheap lots are coming in good locations.”

I disagree 🙂 But I suppose that depends on what your definition of “cheap” is

A gut rehab two flat in a nice part of Logan was listed at just over $200K recently and went under contract very quickly.

It also depends on your definition of “good” location. There have already been places that sold at land value in Logan Square and East Humboldt park for ~$130k. They were then rehabbed and sold in the ~$500k area.

Reasonably priced homes sell quickly, very quickly. In fact, because so little else is going under contract, the only homes that are selling are the reasonably priced ones. Imagine how hot hot hot the market would be if every property for sale was reasonably priced.

There are crapshacks in my neighborhood languishing on the MLS for the $300’s for 568 days now and counting. There’s one nice house on a nice lot in my area that’s listed in the $500’s and they haven’t and it hasn’t budged in months.

Now if the crapshacks sold in the $100’s and the home homes sold in the $300’s or low $400’s then the market would have a decent chance at returning to ‘normal’ or historical standards. But sitting on a crapshack priced in the $300’s for years isn’t going to help the situation one bit

“B on July 14th, 2010 at 10:05 am

It also depends on your definition of “good” location. There have already been places that sold at land value in Logan Square and East Humboldt park for ~$130k. They were then rehabbed and sold in the ~$500k area.”

Just curious, what would be a “reasonable priced” standard chicago lot sell in LP/LV/BT/WP area?

“Just curious, what would be a “reasonable priced” standard chicago lot sell in LP/LV/BT/WP area?”

Too broad a set of areas to give good numbers. You’d be hard pressed to find a LP lot for under $700, unless its an extremely suspect location. LV the floor is a generally around $600–theres that one on Ravenswood I noted for $350, and the folks looking for one in a good LV location for $550, so that gives you an idea. BT/WP (even broadly speaking) is going to be tough below $400k, except right along the Kennedy. There’s a lot of possible downside on all of those prices, but anything priced much below that doesn’t last long (i.e., LP for under $600, LV under $500 and BT/WP under $350 are out there, but generally don’t last long unless there’s a problem).

thanks!

anon tfo,

you don’t see 3553 marshfield as a decent land site at $350K, decently priced, and that there could be more of these at cheaper levels in the upcoming REO phase?

I love how everyone on here is mad or surpirsed that people are keeping their asking prices too high. People don’t lower their prices because THEY CAN’T. Simply lowering the price $100k is not an option. They don’t have enough money to bring to the table at closing. It’s no surprise that people aren’t taking bigger losses. It’s just not an option for many unless they can arrange a short sale.

“you don’t see 3553 marshfield as a decent land site at $350K, decently priced, and that there could be more of these at cheaper levels in the upcoming REO phase?”

1. Lots of downside in prices, as I noted.

2. Crap location, as I noted. Would you spend $500k building a SFH there? Any idea what’s replacing the Shell?

3. There are ones that pop up, as I noted, but mostly they sell pretty quickly, even now.

“everyone on here is mad or surpirsed that people are keeping their asking prices too high”

Who’s is “everyone”?

anon – okay okay, it’s not everyone. “Some” people keep writing that people should lower or will slash their prices and I’m just pointing out that it’s simply not an option for many owners.

I’m not mad or surprised. I’m just frustrated. Like I said, the lower priced and reasonably priced properties sell within days. The rest just languishes for months on end. Imagine how normal the market would be if sellers just lowered their prices.

But there are lots of sellers that can lower their prices. There are plenty of places on the market with equity. This property here has been listed for over 500 days. $18,000 mortgage. That’s it. Places like this are all over, everywhere. I’m sure the marshfield property above is nearly paid off too.

http://www.redfin.com/IL/Chicago/4329-N-Kostner-Ave-60641/home/13481854

Lower this to $100 or $150 to allow someone to rehab it or even rehab and flip. It does’nt do anybody any good to sit like this for 500 days.

http://www.redfin.com/IL/Chicago/4329-N-Kostner-Ave-60641/home/13481854

Sorry the 500 day property is below. The one above is 30 days this time around, it’s been listed on and off since march 2009

http://www.redfin.com/IL/Chicago/4323-N-Kostner-Ave-60641/home/13480936

sorry, here’s teh link

http://www.redfin.com/IL/Chicago/4323-N-Kostner-Ave-60641/home/13480936

“Sorry the 500 day property is below.”

That’s an awesome yard, kinda dumpy house and a fairly poor location. If they’d had it at $350 in Jan-09, they probably would have gotten it sold. Looks like a project, to me.

This only shows how genuinely little you know about recent market prices. There are 38 completed SFH’s in LV for sale on the MLS for under 600k. Sure sub-450k you’re getting into foreclosure/non-prime location/teardown territory. But there’ss still plenty of nice SFHs in LV for 450-550k.

Of just land in the MLS the sample size is very small below 600k at just 7 but how much does a demo realistically cost?

“LV the floor is a generally around $600”

“2. Crap location, as I noted. Would you spend $500k building a SFH there? Any idea what’s replacing the Shell?”

PNC Bank IIRC

Lake View is a huge area, and there definitely location differentials that ought to add/subtract 10 – 20%. I definitely don’t pay attention to the SFH market in LV, but I wonder how many of those are close to the L without being too close, and also on a nice quiet tree-lined side street, etc.

“There’s a lot of possible downside on all of those prices, but anything priced much below that doesn’t last long (i.e., LP for under $600, LV under $500 and BT/WP under $350 are out there, but generally don’t last long unless there’s a problem).”

I disagree completely about them not lasting long at lower prices.

I know someone who was trying to sell a house (you could live in it- but it was pretty much a teardown)- for the land in west lakeview- not on the El and with a garage for $450k for over 18 months. Also not on a busy street and not a corner lot.

No takers whatsoever. She bought it for $450k so she refused to lower the price and take the loss. Took it off the market recently. Maybe it would sell for $400k? You COULD live in the house (it wasn’t condemned or anything.)

“how much does a demo realistically cost?”

You can’t actually just tear down any house you want.

“There are 38 completed SFH’s in LV for sale on the MLS for under 600k.”

If they are the same 38 “SFHs” that Redfin shows, at least 23 of them are *not* fee simple SFHs on fullsize lots.

And, anyway, it was just a guideline for locations were people are buying to spend $500k+ on new construction. Which (at $500k) is a house that should be on a lot that’s under $300k, but that’s not (yet) prevailing reality in Chicago.