The Starter 1-Bedroom Condo: 434 W. Aldine in Lakeview

Chicago has a lot of great “starter” condos.

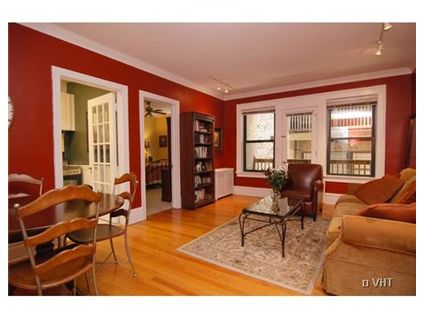

This 1-bedroom at 434 W. Aldine is small and missing some of the “essentials” like central air, washer/dryer in the unit, and parking but it has good vintage bones.

Is this priced to sell for a starter condo in East Lakeview?

Alex Zupancic at @Properties has the listing. See more pictures here.

Unit #1E: 1 bedroom, 1 bath, no square footage listed

- Sold in August 1995 for $97,500

- Sold in June 1998 for $118,000

- Sold in July 2002 for $171,500

- Sold in February 2006 for $209,000

- Listed in December 2008 for $219,900

- Reduced

- Currently listed for $209,900

- Assessments of $215 a month

- Taxes of $2344

- No Central Air

- No in-unit Washer/Dryer

- Leased parking nearby

- Livingroom: 19×13

- Kitchen: 9×7

- Bedroom: 14×14

Looks well laid out and nice area, but personally I’d rather rent a 1 bedroom with all of the missing things before buying one.

“I’d rather rent a 1 bedroom with all of the missing things before buying one.”

Me too. And we’d both save a bunch of money in the process. Also “no square footage listed” = realtorspeak for small. What do small 1/1s in this part of Lakeview rent for? $950?

One bedrooms in my building which is nearby include parking, cable and internet for $1,100. 925 without parking.

Scoop up three (minimum) units, combine them, add a new kitchen, double the bath space, add W/D hookups, buy the parking lot (where ever it is) and then maybe it would be worth consideration.

Come on, even for a starter place, this is ridiculous. And I always love when the listing states “can be sold furnished”. I sometimes hate sitting on acquiantances furniture…cannot imagine buying some strangers furniture!

IMO, this is one of the many places in the city that should have never been converted. The whole point of having the increased living expense is to have something larger and nicer, not just a “I have a condo and you still rent” bragging right.

Warning: someone please, please take down those towels above the stove. One would think that their placement was just a silly and impracticle decorating decision, but I seriously hope no one would be foolish enough to cook with them in their current place.

Looks like bedroom and livingroom look into a light-well utility courtyard rather than the street view. Not only does unit not have a view, but these narrow courtyards also echo with building noise. I agree w/Lauren – some buildings should never have been converted into condos. Won’t sell until unit is priced as a “first apt” rental, given the amount of inventory available on market.

This is not a bad size for a three room apartment.

With heat included, it would rent for about $1200. A much-smaller one-bed with utilities included, in my old bldg on Wellington, rents for about a $1000.

Now, from the $1200 rent you could collect from this place, you should deduct the monthly assessment of about $215 (pays the heat)and taxes of $200/month, you have $800 to cover your mortgage. So, using the most optimistic rent multiplier, 160X monthly rent of $800, you come up with $128K.

Believe me, the lending climate has changed. The numbers now have to make sense. I really don’t believe that any lender is going to give anyone a mortgage for greater than a GRM of 160, nor for less than 10% down until we are on a much sounder financial and economic basis than we are right now.

Also, we are going to see far fewer buyers interested in condos going forward, as people are new to the discovery that as a condo owner, you can end up having to eat huge liabilities run up by neighbors defaulting on assessments along with their mortgages. This building at least is not a recent conversion, which is good, because lenders want to see an established condo association, now more than ever.

lauren is probably right when she says that this building was not a good candidate for conversion. After the RE bubble of the late 80s, and in the ensuing bust, I saw a number of buildings de-convert and revert to rental. Any conversion done after 2003 is probably going to end up being a rental building, and anyone buying into one of these places should use the same rules of thumbs to measure the real value of the place that any other investor would.

looks like a decent layout – i’m sure not the original, as this building was likely a six-flat when originally built.

can any residential appraisers (or someone who is familiar with the current lending environment) tell us to what extent lenders are relying on an income analysis in providing loans for condos and SFR’s?

Laura – i’m also curious wheere you’re coming up with your rent multiplier? in that past i’ve always seen it applied to GROSS rent, not the renta after deducting assessments and taxes.

the way i look at it: At a price of $128k, let’s say 20% downpayment, mortgage 30 year fixed at 4.75% your monthly mortgage would be $535 per month, plus 215 assess and 200 tax total nut of $950. if rent is truly 1200 then this place would have great cash flow, and buying would be cheaper than renting.

how does one “de-convert” a condo building? Buy all of the units from individual owners?

“the way i look at it: At a price of $128k, let’s say 20% downpayment, mortgage 30 year fixed at 4.75% your monthly mortgage would be $535 per month, plus 215 assess and 200 tax total nut of $950. if rent is truly 1200 then this place would have great cash flow, and buying would be cheaper than renting.”

Exactly how these analyses should be done.

So — when the price on this place and similar places drops to $128K, or even $140K, we’ll have something to talk about.

At $210K, it doesn’t make sense.

BB – probably big units split during the war (WWII) – many were split before the city outlawed it.

at a 200K purchase price, 20% down, 4.75 30 year fixed, the mtg is $835 plus $415 ass/tax = nut of $1250. a little higher than monthly rent (per Laura – i have no idea what rent should be).

Except 1200 is a high-side guesstimate:

Heres one for $975:

http://chicago.craigslist.org/chc/apa/1088202253.html

Heres one for $1,035:

http://chicago.craigslist.org/chc/apa/1088215502.html

Also the tax advantages of paying interest on a 160k mortgage are minimal vs the standard deduction, this owner must pay capex to maintain their unit AND lets not forget losing the convenience of being able to move on short notice and without assuming the risk of bringing money to the table.

Oh yeah and lets not forget the opportunity cost of that 40k downpayment.

Maybe I’m out of touch, but in this lending environment, no reputable bank will give you a 4.75% mortgage rate for a non-owner occupied investment property even if it cash-flows.

bubbleboi: where u getting 4.75% for a 30 year term? Bankrate.com says 4.77% for a 15 year term today…. 5.08% for 30 yr

bob – please share with me how you would acount for the opportunity cost. would you also take into account mortgage deduction?

homedelete – this brings up an interesting point. i don’t know how much higher interest rates are for invesments properties (especially condos!) vs. owner-occupied properties, not to mention down payments. But assuming that investor rates are substantially higher, doesn’t this mean that an owner occupant can afford to pay more for a unit than an investor, due to favorable rate?

from what i’ve been told anecdotally, condo investors have all but diappeared from the market. i think at this point, running the numbers is useful to determine if it’s more expensive to rent vs. own. for that i think owner-occuiped rates are appropriate.

chiguy – maybe you would care to run the numbers at 5.08% – should be illuminating.

For the current environment, investment property is at a min of 25% down (unless you know the bank owner), (that was for SFH) condo’s might be higher. Also in response to someones questions, income analysis’s is one major thing lenders are doing (personal income, not rental income (unless a investment property then they take 75% of expect rent (if your lucky).

bubbleboi:

160K (20% down) at 5.08% on 30 YR = 866.75. + 215 asmt + $195/month tax = $1276

I’ll keep my 1br in river north w/ w/d in unit for $1100

Also, the 160 GPM number should be more like 110x or 120x, at least that’s the way it’s traditionally been.

120x $800 a month = $96,000! But 120x $1,100 a month rent = $132,000.

Pretty ridiculously low valuations, right? Of course these are just estimates of value but that’s pretty scary to think the current market could produce sales prices so disconnected from traditional GPM valuations.

But don’t worry, capitulation is only a few months away:

“Local home sales off 29% in Feb. as median prices fall”

http://www.chicagorealestatedaily.com/cgi-bin/news.pl?id=33410

If You assume you get it for 128K, DP of 20%, loan of 5.08%, factor in depreciation and insurance costs, and held it for the next 5 years (assuming 3% appreciation) this place would give you a fabulous $140 a month in beer money

bubbleboi,

Well for this property if you put 20% down thats a 160k mortgage, the standard deduction is ~5,500/year and 5% on a 160k mortgage is: 8k. So you’re really only getting an increased tax savings of ((8000-5,500) * .25)= $625. If you’re not picky about your bank account then sure you could wind up with a 1.5% yield on your downpayment so it could be a wash. But currently you can get a 4% yield in 4 year CDs (and the downpayment isn’t liquid either).

Also in a previous post I showed how $1,200 rent/Laura’s guesstimate is indeed a bit high but it didn’t go through yet due to CL links. Think 950-1,050 for comparable rents though not 1,200.

Realistically this property would need a 40-50k haircut from ask to make it comparable to renting.

Bankrate isnt the end all be all of quotes, plenty of local places will get you a 30 year fixed for 4.75 provided you have a 750+ credit rating (which unless you’re a fuck up you should have).

What happens when a building deconverts, is when it officially ceases to be a condo after the fact that investors own almost all the units.

This happens with unsuccessful conversions, of which there are now multitudes. With these condos, you have an unregulated, choatic rental situation- amateur landlords owning one, two, or three units and regarding them as cash cows, while the individual resident-owners are increasingly outnumbered by these investors.

Eventually, investors own most of the units, which are now selling very cheaply. At the point where they sell for investor prices, some entity usually buys them all and deconverts.

We are a little way from that point, because I’m still seeing wishing prices on substandard Edgewater and RP (and Lakeview) conversions. But later conversions are such spectacular flops that most of the people living in them are still former tenants. At some point, all the gut rehabbed buildings in Rogers Park that are now in foreclosure are going to come on the market, and there might be enough of a glut there to make being a landlord a workable proposition again. I’m thinking not only of Herlo Brothers notorious failed rehabs on Greenleaf AVe, but of a conversion in Edgewater that was done just 2 years ago, at 1215-1225 W Granville, just west of the CVS store. I live in an apartment substantially similar but also a bit better than those on Granville, and people like me are noticing how much cheaper it is to rent. And the rents are not going up much in this climate.

It takes time to get to a 750; the most important credit factor when you start getting that high is ‘length of credit history’. You won’t find too many 20 somethings with scores of 750.

You won’t find too many of any demographic cohort with a 750 FICO these days, especially since a huge chunk of the middle class ($50K-$150K) and upper-middle ($150K-$350K) have larded themselves up with so many big home loans and HELOCs for 5X or more their incomes, never mind their other consumer debt, that fully a third of these people are underwater…… with job losses mounting and many people taking pay cuts.

HD – if you get a CC when you’re 18, it’s easy to have a 750 in your 20s.

Laura – delinquincy rates on jumbos are ~7% and conforming are ~2%… there are still plenty of people that haven’t taken a hit yet. Although it may get to 30%, looks like it’s only 20% now (heavily concentrated in cali, florida, arizona, neveda, etc):

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aOpE4o.BuHfM

Just a thought:

If a $200,000 condo appreciates at 1%, after 5 years, it sh/be worth over $210,000. If your $160K mortgage principal is $150/month, after 5 years, the mtg is lowered by another $10 grand. If you then sell a $210K condo & pay off your $150K mtg, you walk away with $60K from your initial $40K down paymt. (besides having a set housing cost every month & a slight tax savings yearly)

If I am wrong, please illuminate me, I am asking seriously here.

“If a $200,000 condo appreciates at 1%, after 5 years, it sh/be worth over $210,000. If your $160K mortgage principal is $150/month, after 5 years, the mtg is lowered by another $10 grand. If you then sell a $210K condo & pay off your $150K mtg, you walk away with $60K from your initial $40K down paymt.”

@ 5.08%, the payoff after 60 months is $147k. So it’s $60k. But less the transaction costs, which can be up to ~7.5% of your sales price–so $15k. You’re left w/ about $45k from your original $40k–still positive, so still a good thing, but it’s just one past of the whole analysis, if you are considering you home as a 5-year term “investment”.

Everything depends on the financial situation of the person who is buying. If you are in a situation where you have significant capital ($100k or so) and not sure what to do with it, then it makes a lot of sense to buy this place, get a mortgage on the difference and rent it out. If the economy is headed for high inflation – great because real estate will go up in price as well. If we are entering deflationary environment, then the income that you will be getting from your $100K investment will be more than what you can get in any bank.

I agree that if you only have a limited income of $1000-$1500 per month and you are deciding to rent or to buy, then renting might make sense, but if you are an investor with large downpayment who is willing to keep some of his/her money out of stock market, then buying now makes a lot of sense.

at a 200K purchase price, 20% down, 4.75 30 year fixed, the mtg is $835 plus $415 ass/tax = nut of $1250. a little higher than monthly rent (per Laura – i have no idea what rent should be).