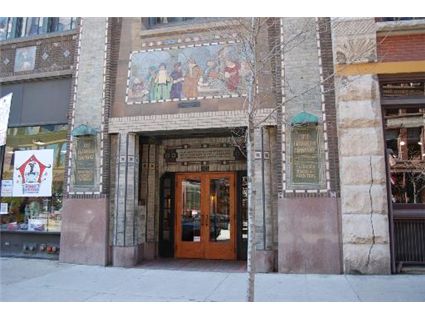

This Printers Row Loft Sells for Over Its 2004 Purchase Price: 720 S. Dearborn

Finally, we’re chattering about a seller that appears to have made some money.

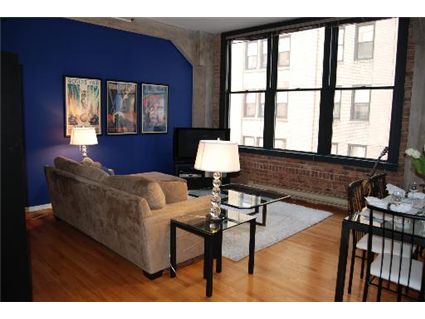

We last chattered about this 1-bedroom authentic brick and concrete loft at 720 S. Dearborn in Printers Row in February 2009.

It sold fairly quickly and has now closed $12,400 under the list price but well-above the prior 2004 sales price.

This was much higher than most of you predicted it would sell for.

See our prior chatter and more pictures here.

Unit #502: 1 bedroom, 1 bath, 825 square feet

- Sold in March 1996 for $91,000

- Sold in June 2000 for $161,000

- Sold in April 2004 for $173,000

- Was listed in February 2009 for $219,900

- Sold in April 2009 for $207,500

- Assessments of $456 a month (includes heat, air, cable tv)

- Taxes of $1952

- No in-unit w/d

- No parking

- Central air

- Tom Feddor at Keller Williams Realty- West Loop had the listing

Congratulations!

Seems as though people are now feeling more comfortable than just sticking their toes in the pool to test the waters.

I think we will be seeing more of these sales…below asking, but above original sales price.

that’s a nice way of saying someone overpaid

westloopelo: Its just the seasonal market uptick, still down year over year for…how long now?

Summer 2009 wont be as great as Summer 2008 (hey that rhymed)

$200,000 1BR’s are manageable _IF_ you have a good down payment. I still say they should be around 180. But I’m a cheap ass 🙂

People are buying, particularly on the lower end. Jumbo market still relatively dead though due to lack of financing imho. However, the phone is ringing with eager first time home buyers.

This is another good sign for the market, especially in the south loop with no in unit w/d or parking. It is great fun reading all of the previous comments from the nega-toids.

For this great price you can afford to have your cleaning person do the laundry once a week!

only 20% above 2004 price

From where this closed at I really don’t get loft people.

Sold above 2004 price? I hereby bring the Hater’s Convention to order. *gavel down*

Sales prices are really just a range of prices both high and low. Some buyers overpay and some underpay. What matters whether more people are overpaying, i.e. the bubble years, or more people are underpaying i.e. now. Of course there are general concepts and one buyer paying over the 2004 price is in no way indicative of a bull market, but if more and more people start paying above 2004 prices then maybe the market has hit bottom. But I doubt it.

MPS… You think the buyer overpaid, but the seller undersold? You make no sense. Are all of the negative people on this site disgruntled renters?

THe seller walked away with cash and was able to deduct the property taxes and mortgage interest for 5 years.

MPS, what did you do for the last 5 years? Rent? Own? Please enlighten us.

folks, people will always need a place to live. and many people, for no other reason than control and the desire to modify/customize, will always want their own place.

the housing bubble was real, but we’re not talking about dot-com speculation here, the underlying need for living space trumps all.

HD – there is no such thing as “the market.” Chicago has always been a hodgepodge of neighborhood-by-neighborhood and block-by-block markets.

people need a space to live, but they don’t need 7 spaces to live. there are so many vacant and empty places.

“skeptic on May 8th, 2009 at 8:29 am

HD – there is no such thing as “the market.” Chicago has always been a hodgepodge of neighborhood-by-neighborhood and block-by-block markets.”

What other NAR cliches can you parrot? it’s a great time to buy? real estate always goes up? Renting is like throwing money away?

Of course there is an market not a block by block markets. People work and live and play all over the entire region and all these factors effect each other creating an overall regional, which again comprises of the good and bad.

I’m not in the business folks, this is just common sense. A temporary glut of new construction doesn’t change the fundamental reality that Chicago’s geographical position as hub of the Midwest ensures we will always have demand for the land.

This just in..from yoChicago…massive price cuts at Pure. Putting ppsf range at 228-400 for the remaining units.

Glug…glug…glug. Whats that…did we just award more scuba certifications?

“Of course there is an market not a block by block markets. People work and live and play all over the entire region and all these factors effect each other creating an overall regional, which again comprises of the good and bad.”

Hey that was a pretty good way of saying something without really saying anything at all. I’m sure you make a great lawyer.

Chicago varies on a block by block basis. You’re telling me that 3000 W. Erie is the same as 1600 W. Erie? Or 3600 N. Lakeshore is the same as 4800 N. Lakeshore? Or that Bolingbrook is the same as Naperville? Or that dumpy two flat next to the brand new 8 story condo tower is worth the same on a price/sqft basis? Dumb.

Err 228-240 ppsf for the remaining units.

Looks like the going rate for condo closeouts is this range. And the buyer of this beautiful loft paid $251/sf with those high assessments even. So South Loop seems to be around 225-255 ppsf these days.

The Ford Fusion is selling great right yet most other vehicles are down. Does that mean that the car market should be segmented vehicle by vehicle? “There isn’t one car market but really it a hodge podge of vehicle by vehicle and manufacturer by manufacturer markets”. Same logic, think it through and you’ll get it…..

“#Sonies on May 8th, 2009 at 8:56 am

“Of course there is an market not a block by block markets. People work and live and play all over the entire region and all these factors effect each other creating an overall regional, which again comprises of the good and bad.”

Hey that was a pretty good way of saying something without really saying anything at all. I’m sure you make a great lawyer.

Chicago varies on a block by block basis. You’re telling me that 3000 W. Erie is the same as 1600 W. Erie? Or 3600 N. Lakeshore is the same as 4800 N. Lakeshore? Or that Bolingbrook is the same as Naperville? Or that dumpy two flat next to the brand new 8 story condo tower is worth the same on a price/sqft basis? Dumb.”

This sounds awfully like “it’s different here”.

Except for all the cheap land the banks can’t even give away in the blight of the south and west sides and the farm land that surrounds us for hundreds of miles.

“#skeptic on May 8th, 2009 at 8:54 am

I’m not in the business folks, this is just common sense. A temporary glut of new construction doesn’t change the fundamental reality that Chicago’s geographical position as hub of the Midwest ensures we will always have demand for the land.

“

“The Ford Fusion is selling great right yet most other vehicles are down. Does that mean that the car market should be segmented vehicle by vehicle? “”

Yes because believe it or not, there are neighborhoods/blocks homes that have fallen over 75% in value, while some neighborhoods/blocks have actually not lost any value or even increased in value!

Its not hard to figure out and by lumping shitty southside properties with places like 340 OTP is retarded.

Calling my position ‘retarded’ doesn’t change the fact that a little bit of critical thinking refutes the block by block fallacy.

Please enlighten me oh great one. Because stating that properties are not unique is false.

This unit sold for $251.82/sf. Here are the other 3 1BR PR lofts to sell since 4/1:

680 S Federal ST #308 893sf 4/17/2009 $180,000 $201.57/sf

600 S DEARBORN ST #306 1000sf 5/5/2009 $221,800 $221.80/sf

633 S PLYMOUTH CT #706 1000sf 4/27/2009 $237,500 $237.50/sf

I really don’t care for this unit. Calling it a 1bd is a blatant lie, it’s a loft studio. End of story. $200+ for a loft studio is way over priced.

Bob,

Are you talking about Pure Lofts on Morgan in the W Loop? If so, that is a pretty big drop in pricing. The info I received when I first moved here put the ppsf at $368-400+. I think the highest priced 2 bdrm was in the high $400s and it was a very nice unit on the top floor. Had I not received such a great deal on where I am now, I would have picked one of those units for myself. I love the look of that building!

One thing that did raise a red flag was shortly after I visited their sales office, there was a huge stop order sign on the front door. Made me wonder if there were major problems or financial issues with it. Even now it seems there are a high number of units available…maybe 25% or so of the units appear to be furnished or are lit up at night.

Yeah those are the ones. I know I’ve sworn off the condo phase here as I think living in a starter condo (1/1) is a huge risk these days with a shorter time horizon (less than 10yrs), some of these 2/2s look like they might make sense at these levels.

For instance Vetro’s ’04 units and Pure’s ’04 units. Mid-200s for a 2/2 isn’t bad at all IMO. What I consider a deal.

Lots of red flags with Pure, however. Developer is missing and the bank is now running the sale process. Potential for a lot of problems but at these price points dare it might be worth the risk.

Using an online appreciation calculator:

+3.7% from 2004 to 2009.

+2.9% from 2000 to 2009.

I thought that the “normal” average appreciation (not bubble numbers) is in the 3-4% range, so are they really out of line on this one?

Or are we more looking at the price per square foot here?

And when is which number more relevant?

Strange how in the W Loop there are a large number of condos that have been finished or are now in the final stages. I have seen pricing from, well $200’s now for Pure to over $1,750,000 for some townhouses. Out of all of them, the more affordable units are not selling, but the higher end units, $600+ ARE moving. Across the park from me there is a new building in the finishing stages with 4 simplexes, 2 duplexes and 2 penthouses that started in the low 600’s and they sold out before they are even finished.

Talk about neighborhood vs neighborhood sales differences, seems block by block is happening now.

Those Vetro ’04 units are 1BR + den. No window, door or closet in extra room. Not to mention, that den is carved out of the LR and leaves little room available in the odd-shaped remains for, say, a couch. If they are 1,000sf, they don’t look it.

Different sales on different blocks does not create different markets. How far do you want to subdivide the ‘market’? Block by block? building by building? floor by floor? that’s like saying oh there’s a great market on the 8th floor of this building but the market totally sucks on floor 13 with a mediocre market on floor 18 but it’s really hot on the penthouse floor. You want to divide markets into block by block, why not floor by floor?

“Talk about neighborhood vs neighborhood sales differences, seems block by block is happening now.”

this remind me of three years ago when I tried to refute the rea estate always goes up argument. I said “real estate prices will fall and here’s why” and everyone said “you’re retarded, you’re an idiot, you don’t know what you’re talking about, prices will never fall.” Today I tried to refute the often repeated NAR mantra that there is no real estate market, just a collection of submarkets, and I say “there is a regional real estate market in Chicago” and again I called called names and told I don’t know what I’m talking about…..

some things never change.

Why not floor by floor? Most places charge a premium for living on higher floors or facing certain directions (better view = more expensive). I know in my building i’d much rather pay 10-20k more for my view that I currently have vs. staring into a brick wall, or a neighbor’s window 3 feet away. You’re wrong, admit it.

“…in the W Loop….but the higher end units, $600+ ARE moving.”

There are currently 77 condo/TH listings available on the near West Side for $600K+. There was one sale of same in April 2009. There were 4 contracts for same signed in April.

There are currently 17 detached house listings available on the near West Side for $600K+. There have been no sales of same in 2009 (last was in 10/08.)

“There are currently 77 condo/TH listings available on the near West Side for $600K+. There was one sale of same in April 2009. There were 4 contracts for same signed in April.”

But how many new listings in April, G? If it were less than 20, we’re under 5 months of supply, right G? Right?

I’m not wrong at all. maybe we’re fighting over the semantics of the definition of ‘market’ but because properties on one floor are selling for a higher price than a lower floor does not mean that they are submarkets or different, or, like skeptic said, that there is no chicago market. You combine all the sales together in the region and that defines the market trend. We can argue over region b/c every gov agency and reserach group defines them differently but you cannot say that different floors are different markets, they have different prices. I’m just refuting the standard NAR lines of BS they feed just like “real estate never goes down” and such.

“Except for all the cheap land the banks can’t even give away in the blight of the south and west sides and the farm land that surrounds us for hundreds of miles.”

The south and west sides will revitalize, by which time people like you will be singing a different tune.

And by farmland, do you mean flood plains that have no access to the job sectors? Ridiculous.

Chicago is far, far, far from the bubble meltdown that the worst areas in the US are (rightfully) seeing a correction from. We aren’t Phoenix, Las Vegas, or all of this goofy CA towns that saw completely insane speculation. There is this thing called LAKE MICHIGAN which provides the most valuable and in-ever-dwindling supply resource on earth, it’s called freshwater.

Perhaps you’ve heard of the stuff. They won’t be running any pipes out to Plainfield to share it anytime soon.

Infrastructure it what it’s all about. And even Hizzoner’s epic boondoggles don’t change the fact we got it.

Since you are privy to such detailed info G, I will concede w/o a debate. On average up to a month ago I dealt with (I’d safely gues), 3-5 agents a day…every day. While I know not to base much of anything on agents touting any one area, these ‘fun facts’ seemed to be repeated day after day…perhaps just to reassure themselves that there were sales transactions happening.

I still am left wondering though, I know of at least three $500+ units in this area that did change hands from March – present. How would we account for that fact? 🙂

We?

I posted current listing and April stats in response to your claim about $600K+ properties.

I said nothing about your new “facts.”

“I know of at least three $500+ units in this area that did change hands from March – present. How would we account for that fact?”

Or, to be more specific that G was, $500k is less than $600k and “March to present” is a longer period than April. And “changed hands” is not necessarily clearly defined.

LOL Proofread WL…..yes that should have been $600k not 500.

And yes, they did in fact sell. The fun facts I mentioned were just agent speak n not much more, but there were def 3 that sold in that time frame.

In rereading your data, they were covered in that time….never mind. You are right. And I do know of the closing in April.

No, they won’t be running any pipes out to Plainfield anytime soon. Because they arleady did so in 2004:

http://www.highbeam.com/doc/1N1-10258E029C1AD56E.html

“Perhaps you’ve heard of the stuff. They won’t be running any pipes out to Plainfield to share it anytime soon.”

hot damn, that’s what I get for pulling a suburb out of thin blue air.

my poor choice of towns notwithstanding, I wouldn’t go banking on this being repeated regularly – and what can be given and can also be taken away.

Yeah just like “the south and west sides will revitalize”.

LOL. Hilarity Friday?

beats douchebag Wednesday.

but seriously, of course they will, just depends on your timeframe.

“of course they will, just depends on your timeframe.”

Most investment decisions are done within the scope of a few years. Even the longest ones are generally within the scope of one’s lifetime. I don’t think you can present a compelling case that the south or west sides will be magically gentrified even 30 years from now. At best it would be speculation. My speculation is that little changes.

In the long term we’re all dead.

“I don’t think you can present a compelling case that the south or west sides will be magically gentrified even 30 years from now. At best it would be speculation. My speculation is that little changes.”

I don’t agree with that. I first came to Chicago for my 20th Bday and have spent all of my ‘milestone’ Bdays (25, 30, 35, 40 etc.) here as well. In looking back, each time I came back I saw areas that were horrible during the previous visits but they were transformed into new neighborhoods.

As an example, I recall when the Grant/Millenium park where the fountain is was a broke down area with no grass at all. That whole area was seriously neglected and was real eyesore. I remember being offered all types of drugs and ‘dates’ from both genders! When I read that printer’s row was going to be renovated, I just could not imagine that it would be a successful renovation at all.

To walk through it now, there is nothing left of that time/image now.

Englewood is a long way from becoming Printer’s Row.

westloopelo,

The areas that gentrified gentrified for a reason. In the case of Printer’s Row it was its proximity to downtown and all those jobs. Other neglected neighborhoods of Chicago don’t have as much going for them. Pullman just isn’t blocks from thousands of jobs and so will never attract higher income people en masse.

I know HD and Bob…just the optimistic in me…