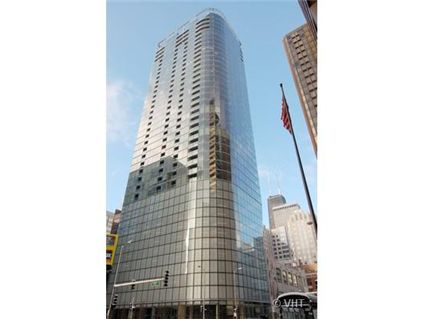

Update on 600 N. Fairbanks: Unit #1301 Under Contract

We’ve chattered a lot about Unit #1301 in 600 N. Fairbanks. It is the lowest level three bedroom, two bath.

It has finally gone under contract after six months on the market and numerous price reductions.

Here is the history:

Unit #1301: 3 bedrooms, 2.5 baths, 1746 square feet

- Sold in November 2007 for $805,000

- Originally listed in January 2008 for $929,000 (plus $60k for parking)

- Reduced

- Was listed in March 2008 at $895,000 plus $60k for parking

- Reduced again

- Listed in early April 2008 for $839,000 plus $60k for the parking

- Reduced again

- Listed in early May 2008 at $799,000 plus $60k for parking

- Reduced again

- Currently listed for $789,000 plus $60k for parking

- Now under contract

- Assessments of $585 a month

- Prudential Preferred has the listing

Stay tuned.

There have also been a few other units going under contract in the building, including a 2 bedroom/2 bath. They have not yet closed.

Current stats on the building:

- 37 for sale (with a few under contract)

- 8 for rent

I don’t like the concrete ceilings and support columns. It looks too gritty.

you can get it skim coated easily. neighbors have done it.

One year from now this buyer viewed will be very astute or a naive knife catcher.

I still think it’s too early but a reasonable case can be made that the worse is over.

Biggest risk…the unsold units will cause liquidity problems for condo board if dues start going unpaid.

This is what I find amusing about this building. Supposedly everyone who bought in there wanted the “modern” look and now they’re all covering the concrete with paint, drywall and whatever else.

Why not just buy in another building then?

I realize what looks good on paper (and in pictures) isn’t the same when you live in the space- but you’re taking away some of the unique features of the interiors of this building by covering it.

“I still think it’s too early but a reasonable case can be made that the worse is over..”

But it’s merely a flesh wound….

Sorry, but there really isn’t much of a case to be made that the worst is over. The price of this unit is still trending downward and it will hurt the comps in the rest of the building. Inventory is still creeping upwards – near 12 months; and sales have literally plummetted off a cliff – 40% or more in decent areas of the city. Mortgages are more difficult to come by and interest rates have been creeping up.

I like the modern look of this building too but I don’t see unpainted concrete as quintessentially modern. A white paint coat I think would seem ‘gritty’ enough for me.

I am a big fan of exposed concrete–but frankly, I don’t think the concrete in this building was done well. I’ve seen it up close, and it is rough. In fact, the unit I saw still had some chunks of torn wood embedded in it, and occasional blobs of what looked like caulking material. And needless to say, it had not been polished smooth. If I were an owner in this building, I think I would have gone nuts on the walk-through. I heard another person complaining on this site about the quality of the concrete job, and… they’re right. (I’ve seen exposed concrete up close done well, as in the Vetro and CMK’s 1720 S Mich. Of course, those were model units…)

I think that is the point of the concrete… to look rough and unfinished vs the nice finishes. In fact there is some writing from the construction workers (not I love …, but rather numbers they were crunching). I live in this building and did not care for the concrete in the beginning but it has grown on me to the point that there is no way I would change it. It adds a character in a high rise that you usually have to live in a dark loft or in a not so great area. Obviously I am biased, but I have spent a lot time living with it and I do like it.

Do we know what units recently closed in the past 3-4 months for 1 BR and 2 BR in this building (with and without parking)?

As of this date we have not seen that many closing prices…I know that a two bedroom flipped for the lower-mid 600’s and other units are contigent or under contract but we have not seen the actual closing prices. It seems the smallest units (06) tier are under pressure with 1506 prices at 389,000 plus parking.

Any update on your friend’s unit purchase?

My friend is closing in August.

Little Boi:

Why is your friend closing in August? Is a renter vacating the unit beforehand?

Some may say the rough concrete is the look but it saved the developer a lot of money. Same thing for having rough exposed concrete on 40 flrs of the elevator areas.

Sabrina:

I talked to him and he said No there is no renter currently. His lease does not expire until end of August, so he wants to have some sort of overlap when he moves in and out.

Make sense for me I guess, because if I were him I would do the same beacuse why closing early when you still have a place…

I feel bad for the seller though because … he or she probably needs to pay for the mortgage for June and July and .. maybe August! (if my friend closes end of August!)

Little Bois,

What is the unit number? I’ve actively been looking for a duplex in the building in the 600-700 range (yes, I’m a dreamer). I don’t notice any new 1 bedrooms under contract on my auto feed. Please explain.

a duplex? there are only 2 or 3 duplexes in the entire building and they’re penthouses that are 2+ bedrooms.

“a duplex? there are only 2 or 3 duplexes in the entire building and they’re penthouses that are 2+ bedrooms.”

Maybe that’s why Millie is a “dreamer”!

the 1 bedrooms that still are for sale are:

2908: $499k

3603 $485k

3206: $479.9k

2703: $450k

1503: $450k

1808: $449.9k

3406: $445k

3306: $442k

2809: $439k

2406: $429k

1703: $435k

1508: $421.9k

2306: $417k

3606: $399k

1506: $389.9k

Maybe Millie thinking of combining units to make a duplex… two 1 bedrooms??

The concrete in this building is awfully rough and a lot of the higher floor units have holes in the concrete that don’t look good. I drywalled my concrete wall and am glad I did it. The concrete ceilings and pillars are edgy enough for me! It looks like this flipper grossed about $45k since the original purchase price likely included parking. Thus, the price of the unit is not trending down, it’s trending up. Asking prices are not the same thing as actual closed prices!

D

Contrast this:

“It looks like this flipper grossed about $45k since the original purchase price likely included parking.”

With this:

“Asking prices are not the same thing as actual closed prices!”

Then ask if we know what the flipper grossed yet. Nope. And that $45k (actually $44k) is short of the $50k+ in (presumed) realtor commission. So, whether the prices are trending up or not, this flipper likely lost money on the sale, never mind the 6+ months of carrying costs.

You don’t seem to understand the math. They bought it for $805k and they flipped it for $789k plus $60k for parking (assuming the list price is the price it went to contract at). That orignial $805k included parking, so they’ve sold it for $44k more than they paid, or $849k.

I agree that they probably lost money in net, but you should look up the definition of “gross” (it means before expenses). Anyways, they may have done even worse if they put any upgrades in. Either way, the unit went up in value since November, so that’s got to be a good sign for other people trying to move units. Sabrina, do you have any updates on 550 St. Clair or Avenue East sales?

D

DB (how apropos):

Read your prio post: “Asking prices are not the same thing as actual closed prices!”

It’s only under contract; we don’t know what they actually sold it for, so we don’t know what their profit is, gross or otherwise.

And net losses are not a good sign for people trying to move units–too many can’t afford to bring cash to closing.

anon, there will be knife-catchers leading the market down, as this buyer is attempting to prove. How else can we mark the decline?

I specifically said “assuming the list price is the price it went to contract at.” Perhaps only “DB’s” like me are able to read. As for the possible net loss, it’s obviously not good, but the fact that the unit sold for $45k more than it did in November is certainly not a bad thing.

D

“the fact that the unit sold for $45k more than it did in November.”

Hey DB, is that really a “fact?”

Can you even read? I used the word “assuming” repeatedly. Now you are just arguing semantics because you are being presented evidence that doesn’t support your dire world-view. Pathetic!

D

We won’t know how much money was “made” or “lost” until we get a closing price.

So- neither of you really knows anything right now. Why argue about it?

We’ll have to wait and see.

Deaconblue:

I’ll do an update soon on 550 N. St Clair and Avenue East, but as far as I can tell, not much has flipped in either building (if anything.)

Avenue East started closings just about a year ago. The developer is still trying to sell units.

So are we saying the $805k original purchase price in 2007 already includes 1 parking spot?

Let’s assume the seller bought 1 parking spot (who knows how many spots he bought)… I believe the seller has only 1 parking spot. We know 1 parking spot ranges from $55k to $65k (let’s use this).

If that’s the case, then the original purchase price WITHOUT parking ranges from $740k to $750k.

Asking price = $789k

Parking = $60k

So if the NEW BUYER closed for $789k + 60K which is $849k, then the seller makes some money (the difference between $849k and $805k)…

But, if the NEW buyer closed for anything less than $805k (w/ parking included), then the seller looses money in this case.

Also, if the NEW buyer closes for anything less than $740k (WITHOUT PARKING PURCHASE), then the seller ALSO looses money in this case.

Is my logic correct?

“Thus, the price of the unit is not trending down, it’s trending up.”

With all due respect, let’s keep the discussion above board. You know as well as I know that the closed price last November was likely put into contract/locked in 2+ years ago.

I am sure this unit would have received a higher asking price a year ago vs now, but of course it wasn’t available at the time.

This building is definitely trending down, as is this unit line, as is this building, as is Streeterville, as is Chicago, as is the nation generally.

You don’t come off as uninformed or ignorant, so I assume you are being intentionally duplicitous.

Investor to DB: “You don’t come off as uninformed or ignorant, so I assume you are being intentionally duplicitous.”

I think it is due to cognitive dissonance brought on by fear and panic.

Hey DB:

“I specifically said “assuming the list price is the price it went to contract at.” ”

Re-read your original post about “trending up” at 9:25pm on June 4. The relevant portion is:

“It looks like this flipper grossed about $45k since the original purchase price likely included parking. Thus, the price of the unit is not trending down, it’s trending up. Asking prices are not the same thing as actual closed prices!”

NOTHING about assuming, unless you’re relying on “looks like” as a weasel phrase. Perhaps if you avoided things like “you should look up the definition of “gross” (it means before expenses)”, then you wouldn’t face a parsing of your own defensive nonsense.

Are you kidding me? As soon as we started analyzing it I said “They bought it for $805k and they flipped it for $789k plus $60k for parking (assuming the list price is the price it went to contract at).” Plus, you assumed that they had to pay a real estate commission, which most flippers don’t because they try to do it themselves. The reality is that we don’t know what occurred but it looks like the unit likely went up since November.

D

Little Boi,

You’ve got it exactly right, the prices on units already closed on include what they paid for parking, which ranged from I think $40k or $45k on the low end to $65k max. FYI, I think the most that you could have spent on unit upgrades would have been about $40k. I can’t tell from these pix if the kitchen had any upgrades, but I think those cabinets were standard.

D

No, I’m not kidding. I’m looking at your first post (9:25pm) where you stated:

“It looks like this flipper grossed about $45k since the original purchase price likely included parking. Thus, the price of the unit is not trending down, it’s trending up. Asking prices are not the same thing as actual closed prices!”

Then I pointed out (at 8:21am) that we don’t know what they grossed yet and further noted that they (likely) lost money (on net–not stated, true), at least after carrying costs. Then you were insulting–“you should look up the definition of “gross” (it means before expenses)”.

Now you’re trying to revise what you posted, but it’s all right there in pixels. Maybe you meant to include another line in your first comment, but you didn’t.

“The reality is that we don’t know what occurred but it looks like the unit likely went up since November.”

A more accurate statement would have been, “it looks like the unit likely went up from when it was put into contract 2-3 years ago.”

And even then, you have to figure that precon pricing that far out usually gets a 10% discount from what it’s hypothetical market value would have been if fully built.

The seller IS using a real estate agent to sell the property (was Koenig & Strey and is now Prudential Preferred) so you have to assume at least a 4 to 6% commission off the sales price.

http://www.chicagotribune.com/classified/realestate/advice/chi-fri_local-scene_0606jun06,0,7879456.story

Good story

Good Story – click my name

We don’t know whether or not they got pre-construction pricing. Only the first 40% of the building received the 10% discount, once they hit 40% sold the developer got his financing and jacked up their prices to market levels. Even assuming he did get pre-con pricing, if he was able to capture a 10% appreciation rate over the past 2-3 years, that’s not bad at all for the building (although not so good for the flipper).

D

P.S. anon, I’m not going to argue semantics with you anymore, your clearing trying to steer the scope of the argument away from my original point.

Deaconblue,

I’m not following you. How did he get 10% appreciation rate?

Let’s assume the best case scenario for him: He sold it at full asking.

That means he bought it for 805k in November, sold it for 849k now.

Looks more like his best case scenario is a 5% gain. Would that even keep pace with inflation over the last 2-3 years?

I was simply replying to your mention of 10%, I didn’t do the math. The actual discount on this building was 7%, based on the pre-construction prices for units versus those that sold at later prices, adjusting for the floor the unit is on. I agree that the flipper’s gain was lousy, but let’s assume they got the 7% percent discount. They would have had to have bought it, at the very latest, during Q1 ’06 because that’s when those prices ended. I think most of us can agree that mid ’06 was the peek of the bubble. If they sold it for $849k, they made 5.5% gross, while they would have sold it for $865 if the 7% discount would have held. That means that worst case (that this unit was bought at pre-construction prices and only captured 5.5 of the 7% discount), the unit has only dropped 1.9% since mid ’06 (865k minus 1.9% is $849k. My point is that if they closed at $849, this unit is only 1.9% off of peak, 2006, prices. I’m sure certain folks will argue that they are “knife-catching” and that the units will plummet from here, but that’s not bad considering what we’ve already gone through over the past 2 years.

D

This just in: Sellers at 600 North Fairbanks have lost their minds.

Unit 1402 just showed up for 600k, while unit 1602 is still sitting for a good time now at 555.9k.

(Maybe I’ve missed something, perhaps 1402 includes parking?)

All I can think of is parking and/or upgrades. That’s weird though…

I believe this site is just South of 600 N Fairbanks. According to Crains, it sold for $11.6 million.

http://www.chicagorealestatedaily.com/cgi-bin/news.pl?id=29898

Hi,

Does anyone know why this unit is now listed for rent by a Coldwellbanker agent? As far as I can tell on the MLS, the sales hasn’t closed yet. Is the new owner trying to rent it already?

Hey,

Does anyone know if the unit closed? The MLS says no but. listed for rent by another agent for RP: $4,700

JL:

That location IS just south of 600 NF. It’s the parking lot with the Hot Diggity Dog stand.

So if you buy a south facing unit in 600 NF, your view is about to be blocked (IF they get the financing to actually build this building.)

Hello,

I just found this website, and I can’t believe there are so many fairbanks lovers (and haters!) in this forum! Well … I will be closing a north facing 1 BR in this building in August! I am so excited 🙂

So, does anyone know if the dryer in the unit is an electric/gas dryer? My unit does not come with a washer/dryer, so I need to buy on my own, and need to know the dimension of the laundry room as well as whether it is a gas or electric?

Any 1 BR owners out there? What washer/dryer do you guys have? I want to get a nice one (Miele, etc.).

Appreciate the response!

hi. we have a north facing 1 br as well and went through the same search for a washer/dryer. 1st off, it is gas. 2nd, the closet is so small that the only unit that actually fits into it is the one the building was offering (i think it’s the whirlpool). abt and sears both sell it. sorry to be the bearer of the news…. unfortunately nothing else will fit!

also check out the owner forum at http://groups.yahoo.com/group/600nfairbanks/

me,

thanks for the info.. what is the dimension of the laundry room? would you mind measuring it for me and let me know the dimension? also, if you could let me know the model and the dimension of your washer and dryer individually that’d be great, if you could add up and do the total measurement that’s awesome too…

thanks in advance for the help

I have a two bed, but I think the closet is about the same? I have the front loading Whirlpool Duet (“sport” edition, whatever that means) and it has been great