What’s the market anymore? 333 S. Des Plaines

I feel for sellers and agents as they try and gauge what the market is this spring. It’s hard to price properties right now.

All sellers want to make money off their sale. But what is the “market” price and what is listing too high?

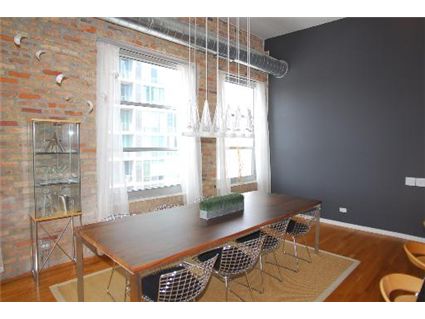

333 S. Des Plaines is a 75 year old brick building in the loop/west loop (east of Greektown) that was converted into lofts in 2004. It has 40 units and parking in the building.

This penthouse unit is on the market.

Unit #707: 3 bedrooms, 2 baths

- Sold in July 2005 for $500,000

- Currently listed for $625,000 plus $25,000 for parking

- Assessments of $413 a month

- Keller Williams Realty- West Loop has the listing

It has large room sizes, with the master bedroom at 21 x 13.

The question to ask is, has this property really appreciated over 25% in less than three years?

Only the market knows.

I dunno–I can’t say I “feel” for this seller. In what universe are they living? Whether you should price at 2003 or 2004 prices, THAT I feel for. But whether you should price at fantasy levels? This is either sheer stupidity or naked greed (and self-defeating, as the longer they wait to price appropriately, the less they’ll get).

I do feel sorry for agents who have to try to convince a seller like this that they can expect to lose money–maybe a lot–on a unit they bought two years ago, especially when the seller insists, “No, let’s try it at at 30% increase and see if anyone bites.”

Is that really a “penthouse” or just a standard unit on the top floor. “Penthouse” should mean something special or at least different.

I am considering buying in the West Loop. Having looked in several buildings close to this one that faced right onto the freeway, or the intersection of the 2 freeways, as the balcony of this unit does, I can’t imagine paying that much for property on that corner. Maybe there’s something wonderful about it that I’m not seeing. The room sizes do look very nice.

How much would this place rent for realistically? I would pay $2200/mo if parking were included. To buy this place it cost me close to $5000/mo (as a first time buyer I’d have to finance 95%). Is there even a question?

I use 200 times rent as a sanity check – yeah I know that’s way higher than some but its a “historic” average for Chicago – that would be $440,000. To end at that amount would I offer $350,000 and hope to work my way to that number? That seems really harsh.

Maybe my rent or multiple assumptions are messed up. I’m interested in what others think – what would you “seriously pay”? Given that this amount would likely “insult” the buyer – how would you begin a negotiation – with your first and final offer or with some other much lower figure aimed to work up from?

Your rent on this 3 bedroom would be closer to 2800/month. I have rented out 2bed/2baths (1250sq feet) for $2000-2200/month.

All sellers want to make money off their sale. But what is the ”market” price and what is listing too high?

—

This might scare some of you, so look away. Here is how you find out what a unit in that building ‘should’ cost: Take every inhabitants’ income and add it together then divide by the number of inhabitants = X. Take X and multiply it by 3 = Y. Y is what real people that live there can afford.

Too many housing bubble arguement evently fall on ye olde “Some Lawyer or Doctor Will Buy It” standby. Guess what the average lawyer does not make that much money, and doctors are fleeing the state of Illinois bec of high insurance rates. There will be no white knight to ride to the rescue of these fair flipper madens.

The market will correct untill prices fall back into line with the local’s incomes. Yes, some locals are very well off. But not every condo builing from Irving Pk to Cermack to Ashland to the Lake can be in the 600 – 700+ k range. There are not that many rich and famous people that want a 2 bed condo. Sorry.

Stuckinthecity, I disagree… There are 2nd most millionaires in Cook County than any other county in the Country of USA…

[There are a lot of millionaires in the United States. More than ever, in fact, according to recent research published by London-based market research firm TNS. But are they turning to financial advisors for help? Well, yes, and no.

TNS recently reported the number of millionaire households (those with $1 million in net worth, excluding primary residence) has risen for the fourth consecutive year to a record high of 9.3 million — a 5 percent increase from the previous year. California happens to be home to four of the top 10 counties in number of millionaires. See the table below.]

The 10 counties in the U.S. with the highest number of millionaires Number of millionaire households Millionaire households as % of total state households Millionaire households as % of total U.S. millionaire households…

1 Los Angeles County, CA 268,136 23% 3%

2 Cook County, IL 171,118 40 2

3 Orange County, CA 116,157 10 1

4 Maricopa County, AZ 113,414 62 1

5 San Diego County, CA 102,138 9 1

Stuckinthecity, I do agree that there will be a correction but the market (agents & sellers) have been correcting itself for the past 6 months now… More and more buyers are pricing homes accordingly and well priced properties continue to go under contract. My guess is the agent had trouble persuading his clients to price accordingly and its going to sit or have a couple price reductions in the near future. This is also a very akward neighborhood to be located in?

The number of millionaires is very deceiving. I guess the definition is someone with assets greater than $1,000,000 regardless of income. So I could be a retiree earning a pension millionaire, a trust fund spendthrift millionaire, a mid life worker-bee millionaire.

In any case I think people make housing choices based off of their income (i.e. inflow of cash from working or investing) – not their net worth. From answers.com “The median income for a household in the county was $45,922, and the median income for a family was $53,784.”

I looked up 60661 and the median household income is $54,698 in that zip code – it says average housing was $353,030. All these numbers are 2000 census. I can believe that since then housing median has gone up but wonder if the income has too.

SLR, there is no way the “historical” rent multiplier for Chicago is 200, especially in high-assessment condos. Try more like 100-150.

city agent, wasn’t it you who said before that foreign investors would save us? Now it will be the millionaires? Did you even notice that the list of most millionaires pretty much follows the same order as total population? And that the large counties with the most millionaires per capita are currently real estate disasters? You might want to look into that.

Here’s what I posted on the 2/11/08 thread titled “Museum Park At Central Station Tribune Ad: How Persuasive?”:

That Cook County stat you posted begs for context, such as a list of the most populated counties:

1. Los Angeles County, CA – 9,935,475

2. Cook County, IL – 5,303,683

3. Harris County, TX – 3,693,050

4. Maricopa County, AZ – 3,635,528

5. Orange County, CA – 2,988,072

6. San Diego County, CA – 2,933,462

7. Kings County, NY – 2,486,235

8. Miami-Dade County, FL – 2,376,014

9. Dallas County, TX – 2,305,454

10. Queens County, NY – 2,241,600

Geez, those first two have an awful lot more people than the rest. I wonder where they appear on the list referenced? Here it is, the list of counties with the most households over $1M in net worth:

1. Los Angeles County, CA – 268,138 (2.70% of population)

2. Cook County, IL – 171,118 (3.23%)

3. Orange County, CA – 116,157 (3.89%)

4. Maricopa County, AZ – 113,414 (3.12%)

5. San Diego County, CA – 102,138 (3.48%)

6. Harris County, TX – 99,504 (2.69%)

7. Nassau County, NY – 79,704 (5.98%)

8. Santa Clara County, CA – 74,824 (4.40%)

9. Palm Beach County, Florida – 71,221 (5.61%)

10.King County, Washington – 68,390 (3.81%)

Of course, the percentage comparison does not take into account the relative household sizes, but I doubt that changes much by county.

By the way, the counties with the highest concentrations of wealthy are already in the crapper. Are there really some people who believe ‘it will be different here?’

No, the millionaires won’t save us anymore than the foreigners. Salvation will only come with price reductions.

SLR,

This is not my study… This is a study done by TNC. They state it is, “those with $1 million in net worth, excluding primary residence”

G, Go to Forbes.com or google Forbes. They have Cook County at 167k which is 2005 numbers…

biz.yahoo.com/special/trophyhome06_article1.html

I’m not arguing that millionaires are going to save us nor are foreigners. I’m commmeniting on a post earlier saying doctors and lawyers are not going to save us anymore. We sure have a lot of doctors/laywers working/living here in Cook County…

If the millionaires are going to save us, why don’t they save themselves first? I’ve seen numerous million dollar homes foreclosed upon in the last six months in Cook County (in and outside of the Chicago city limits.)

Maybe those people had all-interest loans.

But it’s not like I see a bunch of millionaires popping up to buy up all of those foreclosed upon million dollar houses either. They’re sitting there on the market while the bank keeps cutting the price.

city agent on February 20th, 2008 at 5:17 pm

SLR,

This is not my study… This is a study done by TNC. They state it is, “those with $1 million in net worth, excluding primary residence”

&

I looked up 60661 and the median household income is $54,698 in that zip code – it says average housing was $353,030. All these numbers are 2000 census. I can believe that since then housing median has gone up but wonder if the income has too.

&

I’m not arguing that millionaires are going to save us nor are foreigners.

—

City agent, so what is your arguement? You show a stat and then back down. Why did you show that stat if you don’t think they will save us?

Housing was overvlaued as we are learning. Why do we assume that doctors and lawyers and millionaires are dumb people and are willing to pay more for something that they could get cheaper in 6 – 18 mo’s??

SLR has it right. The true value of an item is what people are willing to pay for it. In the recent past, people were willing to pay extra for RE bec they believed that its value would continue to increase exponentially. That belief has hit a brick wall. People now are not willing to pay extra for RE. Even lawyers and doctors and millionaires aren’t so dumb!

First off my father is a Doctor that I respect very much… I’m not assuming doctors/lawyers/millionaires are dumb. I was being very sarcastic in my last posts. I guess you couldn’t tell!

Second, “stuckinthecity”: “Too many housing bubble argument eventually fall on ye olde “Some Lawyer or Doctor Will Buy It” standby” is assuming anyone with money in this city is a doctor or lawyer. I disagree. I was showing a stat because I want “Stuckinthecity” to know that cook county is a very wealthy county. It also happens to be a very poor county as well.

Your way of finding the cost of a property is unrealistic and makes no sense. New Construction is priced accordingly to the costs of building. These costs in 20 years will be much higher than today FYI.

Third, obviously markets are set by how much an able buyer is willing to pay a seller for property, artwork, furniture, spice, salt, a car or a cheetah… Supply and Demand. The greater Demand the higher the price, The greater the Supply the lower the price. This will eventually balance out just like any other market in the history of markets.

Fourth, Prices have been falling for the past 6 months now. Buyers are pricing at very competitive prices and condos, homes and land is selling.

Fifth, this is a website about Flips and Foreclosures. I will state this again about these newer buildings. You don’t have a Crystal Ball. I don’t have a crystal ball. We won’t be able to know about some of these buildings for another 2-5 years. As much as you’re able to talk about the doom and gloom I’m able to talk about the market stabilizing at a much slower pace…

“New Construction is priced accordingly to the costs of building.”

Plus a percentage of profit, which is set as high as the market will bear. You haven’t dealt with corporate level transactions involving in progress developments, have you? The typical course over the last several years of the boom, was regular, substantial increases in asking price unrelated to increased costs of construction. Builders were charging what the market would bear. Costs are part of the justification for price increases, but the relaity is mostly that it’s b/c they can. Does it really cost 1000/ft to build Trump Tower? No, or else the baseline price from day one would have been higher than that.

“These costs in 20 years will be much higher than today FYI.”

Yeah, in nominal dollars. There’s a little thing called “inflation” that, FYI, will (likely, barring extended deflation) mean that it what costs $100 today will cost $200 (give or take) in 20 years. If you adjust for inflation to get “real” costs, they might be somewhat higher, but I wouldn’t expect it to be meaningful unless (1) there is a severe labor shortage or (2) there’s been a total economic meltdown.

“There’s a little thing called “inflation” that, FYI,”

Really… Inflation??? I never knew how that worked! Thanks for the quick lesson!

“Does it really cost 1000/ft to build Trump Tower? No, or else the baseline price from day one would have been higher than that”

No it doesn’t really costs $1000/ sq feet to build Trump. It costs on average a $1000/sq feet to live at Trumo. Yes, it really costs $750million dollars to build Trump Towers though. If it didn’t everyone would be putting up 92 story highrises…Like I’ve posted before “HIGH RISK” can lead to Higher Reward. Excluding the Spire which might not get build it will be the last 90 story residential building for at least 30 years…

“It’s a very big project,” Trump told Reuters. “It’s the largest job built in Chicago since the Sears Tower.”

Your way of finding the cost of a property is unrealistic and makes no sense. New Construction is priced accordingly to the costs of building. These costs in 20 years will be much higher than today FYI.

—

This is precisely where you are wrong. The cost of the building is not the only issue. New Constuction prices has the cost of the LAND built into it. So if the market for RE is dropping, so too is the value of the land. Land valuations are not a constant.

3 times income has been a time honored (pre-bubble) method of determining home purchasing power.

CA, you are really all over the place. My snark was in response to your snark: “These costs in 20 years will be much higher than today FYI”. And, while being snarky, your statement indicated a failure to distinguish b/t real $$ and nominal $$.

If construction costs are actually going to be “much” higher in real terms in 20 years, then god help us all. If they are just going to be “much” higher in nominal terms–so what? So will everything else, including incomes.

I would think in real terms, construction costs would be cheaper in 20 years, as technologies (both techniques for buildings and materials) improve.

Not to mention that construction costs are already dropping because they, too, cannot escape the laws of supply and demand.

“I would think in real terms, construction costs would be cheaper in 20 years”

Quite possible, but I expect that, if adjusted for overall activity (i.e., using 2007 boom pricing for comparison only if 2027 is another boom), energy will be more expensive as well as certain necessary raw materials due to increasing global demand for commodities. Maybe not much more, but somewhat.

“construction costs are already dropping”

Making it finally somewhat reasonable for me to undertake long-deferred projects.