Mandarin Oriental Disputes Troubles with Financing

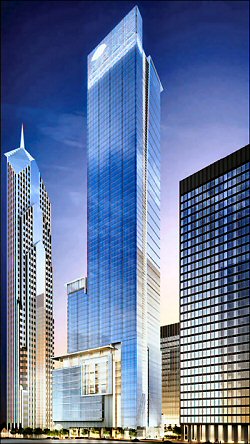

Gosh, condo-hotels are suddenly hot with the media. Crain’s is reporting financing troubles with the Mandarin Oriental, the condo-hotel and condo building at South Water and Stetson near Millennium Park. It hasn’t broke ground yet and groundbreaking keeps getting pushed off.

In Sunday’s Chicago Tribune article about condo-hotels, the Mandarin refused to say what was sold. Crain’s reports:

“The markets are tough, but we think this is going to be a landmark project,” Chris Kenny, CFO of Palladian Development, says. The developers have contracts for nearly 60% of the condo space and 55% of the hotel-condo space, based on square footage, he says, enough to obtain a construction loan.

If it’s so great, why didn’t he give these numbers to the Tribune’s reporter?

Crain’s is reporting that there were $3 million in liens on the property filed by the architect that could delay getting a construction loan. Why would the architect care about $3 million in a project projected to cost $750 million? Hmm…

The Mandarin’s architect was probably willing to let the project run up the bill only to a certain point, in a bet that construction financing would eventually be obtained, says Garry Benson, CEO of Garrison Partners, a Chicago-based residential marketing and consulting firm, who is not involved in the project. “Maybe they lost faith in the project,” he says.

Lost faith? In this market?

Imagine that.

I’ve said before that the Mandarin will never be built. And I’ll say it again.

The Mandarin Oriental will never be built.

(At least not for the next several decades at that location.)

1. Asserting that “most lenders” would see the liens as a red flag is, at best, technically accurate because “most” lenders wouldn’t have any part of a $750MM construction loan and those same “most” might consider it a red flag. I see the assertion as completely wrong. Who cares about less 0.5% of the construction costs? The $3mm just gets paid out of the first draw, as will the take out of the $43mm of land acquistion financing.

2. Kenny may have spoken to Crain’s first and wanted to no comment to the Trib to avoid unintentionally scooping Crain’s. Or the Trib called someone else. Or Kenny has been misquoted by the Trib in the past. Who knows.

3. Most likely, their lien filing period was expiring. The developer probably expected it, having received calls from the architect and the contractor. I’d guess that Mr. Benson gave a list of possible reasons, and that was one of them. Reporters tend to cherrypick the most interesting parts of quotes. The architect having “lost faith” in the project is much more interesting than they had to file to protect their rights under Illinois mechanics’ lien law.

4. Don’t you think it’s reasonably likely that they will try to keep it alive until the 2016 Olympic announcement (October 2, 2009)? Sure, that’s a long time to cover carrying costs, but what the heck, right? And even if they pull the plug, “several decades” is really a long time. “Several decades” ago is world war 2. And if there is a Mandarin Oriental on that site, with construction starting several decades from now, the design will undoubtedly be different.

When we last had a housing boom (the 1920s) in Chicago, many projects were in the midst of construction. Some got built. Some did not. Some projects built only one tower (where there was supposed to be two.) I’ll do a post on Chicago condo/co-op history soon because it’s really interesting. Many of the buildings built for the rich were converted into apartment buildings (and they stayed like that for decades.)

There was no new residential high rise construction in Chicago for decades. It made no financial sense to do so.

The next big residential building boom was in the 1970s (when the John Hancock and other condo towers were built.) How many years is that inbetween the booms? Hmmm….

So, yes, we won’t see the building like we’ve seen in the last decade probably for 30 to 40 years.

Also, you act as if $750 million construction loan is common place in Chicago. It’s not. And in a slowing market? Even less so.

This building isn’t going to be built. How much demand do they think there is for projects like this at this price point? That’s the point of the Tribune and the Crain’s article.

We’ll see shortly as to who is closing on units in Trump.

“Also, you act as if $750 million construction loan is common place in Chicago. It’s not. And in a slowing market? Even less so.”

Huh? I act like the banks that would participate in making a $750mm loan are more understanding about the situations which lead to mechanics liens being filed to not see the fact two liens were filed as being a red flag. Of course a $750mm loan is not commonplace anywhere, in any market. I just think that the guy quoted by Crain’s and the author of the article were trying to spin the liens a a problem for the development–they aren’t.

The point of the Crain’s article (did not read the Trib) is that the filing of liens is a bad sign for the development. Everything else is a bad sign; the liens are a non-issue w/r/t the development itself. Just like the odd sequence of loans at Waterview was not a sign it wasn’t getting built–which was the point of an earlier Crain’s article. They need real estate reporters who get the business a little bit better.

And, finally, there was no residential consruction in Chicago for 50 years b/c (1) Great Depression, (2) WWII, (3) White Flight, (4) fashion for suburbanization. While there might not be high rise residential construction in Chicago for the next 50 years, I sure hope that isn’t the case, as it will take a very negative set of circumstances to have that happen–and while I’m pessimistice, Im not that pessimistic. Oh, and, as you note, the “Last” building boom in Chicago was in the 80s, not the 20s and there WERE a lot of residential buildings constructed b/t the 20s and the Hancock–see, e.g., Sandburg Village.

There was a HUGE boom in residential construction in Chicago in the mid-1920s. A new building was announced virtually every other week during 1925 and 1926. Most of them remain today, adding to our incredible architectural history.

From 1930 until about 1936, there was little high rise construction in the City. Even after 1936, when construction started again, there weren’t the opulent 25 story high rises that were built in the 1920s. The demand was for low income housing. During the depression the government, in order to create jobs, began building large developments of government subsidized housing which became controversial.

Mies constructed some of his glass towers in the 1940s-1950s, but construction of residential towers wasn’t common in this era.

Construction started to pick up again in the late 1960s and continued until around 1980- with condominium buildings being built on the north side of the city. Crain’s recently ran an article comparing this housing boom with the one of the 1970s, where people bought in the John Hancock and units sold out quickly there (some original owners in the Hancock were interviewed.)

I never said nothing was being built- but construction wasn’t anywhere close to the mania that gripped Chicago during the 1920s. If you read accounts from that period you would be struck with how similar they are to today. Hotels were being built all over the city at breakneck pace. Sound familiar?

Many of the buildings in the 1920s were built as luxury apartment buildings for the rich. When the developers (or bondholders) went under during the Depression, some of the renters decided to form a co-op and buy out the bonds. Or sometimes the building was sold to a different group of investors but the building stayed as apartments.

Suburbanization began to happen in the late 1930s. When construction did begin again, it started up in the inner suburbs of Evanson, Oak Park and Riverside. Also, there was more demand for single family housing by this period than apartment living because of advances in transportation.

Sabrina: “I never said nothing was being built”

Come on! your post from 3:56 pm: “There was no new residential high rise construction in Chicago for decades.”

That might not be what you meant to write, but it’s right there, in glowing pixels.

I don’t dispute that (1) there was a big boom in the ’20s (duh), (2) the Mandarin will NOT be built, (3) we’re standing on the edge of a cliff w/r/t residential high rise construction in Chicago (and most of the country), (4) Palladian Development is not telling the whole story (but what developer does?), or (5) most of what you write in your 6:52 post (except the “I never said nothing was being built” part).

I AM taking issue with the characterization in Crain’s (and apparently the Trib), repeated and emphasized here, that the filing of the liens means anything other than that the 120 filing period was about to expire. If the liens were a big deal, then iStar wouldn’t be extending the loan (as noted in Crain’s).

I also think, but could well be convinced otherwise, that Palladian will try to keep the Mandarin alive until the Olympic decision. I really think that if Chicago gets the 2016 games that will drive a lot of development that would have otherwise not happened. The Mandarin is likely in that category and would probably do well in an Olympics-related boomlet.

I also know that many (if not most) Chicago condo buyers in the late-70s, early-80s who still owned in the early 90s didn’t make their money back (in nominal terms) until the last few years. In real, inflation-adjusted, terms, they mostly lost money unless they held on until 2005, 2006. I think the same thing is likely to happen again–15-20 year period before most current condo owners see their purchase price as a sales price, at least inflation-adjusted. I think SFH will do better, at least in the city, because the balance of factors favors people continuing to move back into the city/stay in the city with kids–no likelihood of white flight, improving schools, nicer city on the whole, increased gas price, bad traffic, etc.–which is the key to maintaining home prices.

“120 filing period” should be “120-DAY filing period”

Anon: I agree.

Maybe the Mandarin will hold on until the Olympic announcement but that is nearly 2 years away, right? Maybe a lot will depend on the closings that occur (or don’t occur) at Trump.

And I agree about the condo buyers from the last big boom in the 1970s and early 1980s. I’ve seen some numbers from that period and had a friend run some financial charts on what would have been the return if they had invested their downpayment in the stock market (instead of the condo) and it far and away beats any return on the condo. For instance, if you paid $100,000 for your “luxury” condo in 1979 and now it’s worth $475,000- is that a “good” or even a “great” investment?

It seems like it just by looking at those numbers but when you factor in inflation (as you did above), maintenance, assessments (not tax deductible) and other expenses, the return isn’t really very good.

It comes back to the old adage- you buy real estate to live in it.

Or maybe: don’t buy during the boom!

I’m sure the return would be pretty good if you had bought during the mid-1980s bust and held on.