Market Conditions: 2020 Housing Craze Finally Hits Chicagoland as Prices Spike

We’ve been chattering about the impacts of the pandemic and the protests and looting on Chicago real estate for several months.

The data shows that sales of downtown condos are slow as inventory has exploded to well over 12 months in several downtown neighborhoods.

But single family home inventory was just 2.8 months citywide at the end of August (we’ll be getting the September data shortly.)

That’s incredibly tight inventory.

This scenario means that prices are soft in the downtown condo market, but incredibly hot in single family homes around the city.

Dennis Rodkin at Crain’s recently investigated what is going on with Chicagoland housing prices.

The week that ended Oct. 12 was the ninth consecutive week when the median price of homes sold in the Chicago metropolitan area was up 10 percent or more from the corresponding time in 2019, according to weekly reports posted by Midwest Real Estate Data. In four of those weeks, the median price was more than 15 percent above where it was a year earlier.

But not all properties, neighborhoods or towns are seeing the same hot market.

It appears to be concentrated most in lower-priced areas and first-time buyer markets, where the expanded affordability that low interest rates bring would make a bigger difference than in affluent markets.

The average 30-year fixed mortgage rate just fell to another all-time low of 2.81%.

Will this hot market, and price increases, continue into the historically slow holiday period this year?

And if you’ve been waiting to sell, should you dive in now or wait for the spring market?

Home prices are suddenly rising fast here [Crain’s Chicago Business, by Dennis Rodkin, October 14, 2020]

“And if you’ve been waiting to sell, should you dive in now or wait for the spring market?”

If you’re wanting to sell, get out ASAP. Property tax hikes are imminent, which will add to the depressed market.

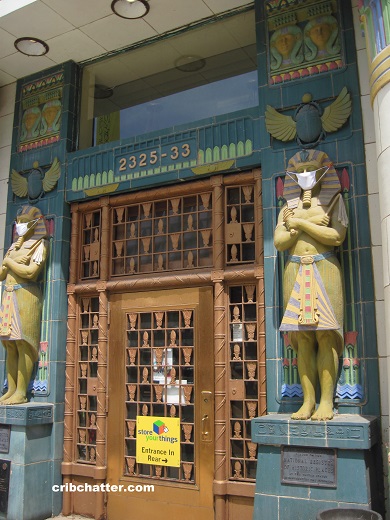

When we de-cluttered our condo to list/show, I rented a truck and stored a bunch of stuff at the place pictured above. Then on moving day, I rented a truck again to go and get the stuff from the storage unit, and pulled it up to the moving company’s semi so they cold transfer the contents. After moving to another state, we rented for about six months, then bought a house. When we moved into that place, I discarded pretty much every single item that I had stored in the cool place on Clark back in Chicago. Totally absurd.

The usual caveat about median prices not reflecting “prices”. I’ll believe it when I see it in the Case Shiller numbers, which still has Chicago at the bottom of 20 metro areas.

“The usual caveat about median prices not reflecting “prices”.”

If you read the article, he talks about how there is a big enough sample size that the “median” doesn’t impact it much. You’re talking about thousands of sales.

“he talks about how there is a big enough sample size that the “median” doesn’t impact it much”

The article also says this, in the same paragraph:

“The median price is the midpoint between the top-priced home and the bottom-priced home.”

Which is ABSURDLY wrong, and evinces that the author doesn’t know WTF he is talking about on that subject.

Any truth to the rumor that a 2/2 in a high rise condo usually has better retail value and more demand than a 1/1?

“Any truth to the rumor that a 2/2 in a high rise condo usually has better retail value and more demand than a 1/1?”

——————————

No.

BTW, Gary, Curbed Chicago has been dead for some time. Do you have a new favorite site (for real estate)?

https://www.msn.com/en-us/news/us/mayor-lori-lightfoot-considering-dollar94-million-property-tax-increase-more-than-300-city-worker-layoffs-and-gas-tax-hike-as-part-of-plan-to-close-dollar12-billion-budget-gap-sources-say/ar-BB1a9usV?pfr=1

tax hikes and reduced services coming soon, as is the Chicago way

She’s screwed.

But that’s a HAWT ™ signal for Chicago Real Estate.

“If you read the article, he talks about how there is a big enough sample size that the “median” doesn’t impact it much. You’re talking about thousands of sales.”

I don’t see what sample size has to do with it. If the mix of what is being sold changes then you have a problem.

“BTW, Gary, Curbed Chicago has been dead for some time. Do you have a new favorite site (for real estate)?”

You must be referring to my blogroll. Nice catch. No, I don’t have another site for Chicago real estate.

“Entrance in Rear”. Hahahahaha! 🙂

“tax hikes and reduced services coming soon, as is the Chicago way”

1,800 vacant positions + 350 layoffs = 2,150 reduction in force. Which we all know is not nearly enough. I guess she’s delaying the real pain until next year, counting on federal funding as she said. Then the RE tax wallop will likely hit, or a Chicago City Tax if the amendment goes through.

City income taxes are common in other midwest states and are usually 0.9-2.9%. So, this being Chicago, 2.9%. That’s what we’ll be talking about a year from now if the amendment passes.

“You must be referring to my blogroll. Nice catch. No, I don’t have another site for Chicago real estate.”

It’s Crib Chatter or nothing. This is the only site that has survived the Google ad apocalypse but that’s because I don’t make a living off of it. I can’t even buy a pizza with it these days.

“I don’t see what sample size has to do with it. If the mix of what is being sold changes then you have a problem.”

If you’re looking at 3,000 or 10,000 sales in that month, it doesn’t matter that 2 $5 million properties sold in the median. That’s his point. The sample size is large enough to take out both the small numbers on the high, and low, ends.

You can have a huge sample size and still have a problem. If a city or neighborhood undergoes a lot of gentrification/ rehabs then what sells today is different than what sold before – higher in that case. It doesn’t mean prices have gone up. Another example would be an area where there is a lot of new construction of better homes.

“it doesn’t matter that 2 $5 million properties sold”

It does if you use the “definition” of median he used in the article:

“The median price is the midpoint between the top-priced home and the bottom-priced home.”

“You can have a huge sample size and still have a problem.”

Of course you can. If you replace 10% of below median values with 10% above median values, the median will go up.

Is that because values are increasing, or because different stuff is selling?

The median value, and the count of sales, alone tells us *nothing* about that question.

“If a city or neighborhood undergoes a lot of gentrification/ rehabs then what sells today is different than what sold before – higher in that case. It doesn’t mean prices have gone up. Another example would be an area where there is a lot of new construction of better homes.”

—————————————-

Not sure if that’s entirely accurate. An economist will tell you that the area gentrified or new construction was started because prices went up to the point where gentification or new construction became worthwhile — that’s the time when, before gentrification, the neighborhood is being “discovered.”

That’s why developers pay what-had-been-unheard-of prices for tear downs. That’s an increase in price.

Correct that gentrification will bring rising prices but the rise in true prices will often be dwarfed by the impact of better stuff selling. And teardown values could go up by more than home values since a tripling of land value will not be accompanied by a tripling in construction costs. It’s just a terrible way to try to gauge price increases.

“It’s just a terrible way to try to gauge price increases.”

Gary

what is the succinct better way for layman reading to indicate price changes?

I really think the Case Shiller index is the most reliable indicator. However, it’s only for 20 metro areas. The FHFA uses a similar methodology for 100 metro areas. The Depaul Institute for Housing Studies looks at similar data for large aggregations of neighborhoods in Chicago.

“Correct that gentrification will bring rising prices”

Or was it higher property taxes leading to gentrification followed by higher prices? Maybe I missed the 800%+ increase in home prices in Bronzeville and South Loop offsetting the property tax increase since 2000? San Fran is only up ~200% in housing prices since 2000 for perspective. Although gentrification is real; in Chicago/Cook County it doesn’t exist. City/County/State government fiscal mismanagement has forced communities out of their homes not the “gentrification” boogeyman or the free market capitalists that is popular to bag on these days.

https://www.chicagotribune.com/politics/ct-cook-county-property-taxes-maria-pappas-study-20201026-sguyjshaafdl3kl3ub5tmxen3e-story.html