Tribune: Upper Bracket Sales Making a Rebound

Mary Umberger, the Tribune’s real estate reporter, talked about the increase in sales of upper bracket properties in the Sunday real estate section. Apparently, Barrington is seeing a spike in sales of luxury homes. And Chicago is seeing the same thing:

I rang up Jim Kinney, president of Rubloff Residential Properties in Chicago, who said the numbers are improving at the highest end in the city too.

Kinney said Chicago has had 103 closings in the $2-million-plus bracket in Chicago since the beginning of the year; up from 89 a year earlier. And in the next rung down—$1 million to $2 million—there were 372 closings in the first six months of 2008, up from 309 in the year-ago period.

Untch theorizes that pricey purchases have picked up because consumers lying in wait have decided it’s time to move.

“I sold a $3.5 million property, and the buyer flat-out told me, ‘Oh, yeah, we’ve been watching it since September,’ ” Untch said. When the price dropped $200,000 recently, the buyer pounced, he said.

But while the rich might not have to worry so much about little things like obtaining a mortgage or actually saving for a 10% or 20% downpayment, does this mean that the market has bottomed and that the lower priced homes will start moving soon?

Unfortunately, in Chicago, there is a little thing called “inventory.”

“The high end comes back first,” Kinney said. “It’s the last to turn down and the first to pick back up. They go to the sidelines when they feel things are going to tumble. They can afford to buy but don’t want to catch a falling knife.”

Neither Kinney nor Untch are doing handsprings, however, because there remains the nagging little issue of a bumper crop of homes still for sale.

“Inventory is up, but at least we’re making a dent in it,” Untch said.

Kinney said top-quality resale properties have held their own in the city, but new construction “is deathly.”

He said the city has 13,000 new units in the pipeline, yet just 200 purchase contracts were signed in the first quarter.

Though he sees the upper-bracket sales as encouraging, they don’t herald a turnaround, he said.

“There is no tsunami coming,” Kinney said. “It’s more like a tidal pool.”

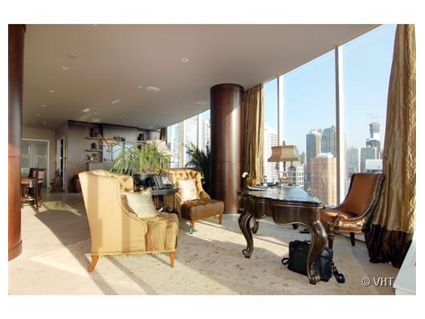

I agree with these realtors that many higher priced properties seem to be moving. In 55 E. Erie, a luxury highrise in River North, 3 units priced over $3 million have sold in the last 7 months.

Remember this unit at 30 W. Oak in the Gold Coast that we chattered about in May?

It sold.

Unit #22B: 3 bedrooms, 2.5 baths, 2 car parking

- Sold in May 2007 for $1.489 million

- Originally listed for $2.999 million

- Reduced

- Listed in May 2008 for $2.849 million

- Sold in June 2008 for $2.35 million

Will ‘high’ tide raise all boats? [Chicago Tribune]

The other 30 W Oak unit (4C) is now at $1.259M plus $45K for parking — a cut of $50K from May (plus $20K on parking).

While I don’t doubt that the upper end is doing fine I don’t understand how it can remain unscathed by what’s going on down below. There should be a trickle up effect. As prices one tier down deteriorate people buying in the next tier up should see the bargains and trade down a bit. Otherwise, they’re irrational – which is entirely possible. However, rationality usually prevails in the long run. Not to mention that the stock market is going down, which impact upper income folks.

Honestly, who feels entitled to make $1 MM for holding on to a property for 1 year? It absolutely blows my mind.

If you look at the concentration of wealth in this country it has gotten increasingly concentrated at the high end the past decade or so. This trend might have something to do with the high end of the market holding up better than the middle or low end.

That purcahse price was almost certainly a pre-consruction price. When did the marketing 30 W Oak? 2003? The date of the original price setting and the normal pre-const discount could make up a big piece of that $860k.

IMHO, the change in wealth demographics in the USA has to do with individual investors not having access to the sophisticated wealth managers and investment structures offered to those with a net worth above $3 million. Also, I think the pension funds and the like have not managed their money well for investors. I listen to friends in i-banks talk about how they target pension funds and government agencies because they can sell them junk. I am sure you have seen articles that town about town governments with an investment fund that was sold CDO’s and other SPV’s that they should not own based on their risk structure. There is a correlation between what your money manager makes and performance. Would you want to work for a pension fund and make $80,000 per year when a person in a similar position at an i-bank makes $250,000, including the bonus? This same issue exists in our government. The brain power goes where the money is.

It’s a myth that the upper end is comprised of rich people immune from ups and downs of the broader economy. Posts on this board have shown time and time again that a significant number of ‘million’ dollar homes are purchased with toxic or quasi-toxic finaning i.e. interest-only jumbo ARM balloon loans. If the upper end was truly immune they would be paying in cash or taking smaller mortgages. $800k jumbo and $1,000,000 super jumbo loans are nothing more than the californication of the high end of the chicago housing market. A $1,000,0000 super jumbo loan to buy a $1.250 million dollar home is nothing more than a high-income DINK couple with steady jobs – again that’s not wealth, that’s just flirting with financial suicide. If one of them were to lose their jobs or if interest rate spike in the next few years, they’ll be forced to sell or go into foreclosure.

Some of those units were sold as raw space,so it is possible this owner finished out the unit and has much more money into it vs the sold price.

Looks like I am not the only one saying things are not THAT BAD!. You guys should go back to school and learn a little baout supply and demand before predicting your 30% declines and return to 1999 pricing.

You are just flat out wrong!

HomeDelete – Renting is financial suicide. Purchasing a quality property is weatlh management…

Bob – The current administration has everything aimed to the higher end of the market. The rich are richer and the middle class is nearly gone. Better neighborhoods will do great as I have been saying all a long…

Of course there are a number of truly wealthy families buying expensive compounds and estates, i.e. CEOs of publicly traded companies, lottery winners, old money, etc. That’s probably reflected in the 89 closings above $2,000,000 this year. If I were to hypothetically* extrapolate that figure for an annual figure that means there are less than 200 closings per year on properties above $2,000,000. In a major metropolitan area with 2.8 million people in Chicago and more than double that in the 6 country area, $2,000,000+ is a very minor slice of the market.

* I say this because it is guaranteed someone will ridicule my extrapolation. Because of course, in their world, 90% of $2,000,000 closings occur in December so it’s totally inappropriate and wrong to double the mid-year figure for an extimated annual total!

Upper bracket may be making a rebound? My wife and I did the Bucktown Garden Tour yesterday and walked the entire neighborhood. The lack of open house signs and homes for sale was shocking. It was a beautiful day in the middle of July and we saw two open houses. At the first, the real estate agent saw us looking at the home from the sidewalk, open the door and begged us to come in. The second open house was a converted funeral home. Most of the sfh’s for sale seemed to be “by owner”.

I understand that some of the homes in Bucktown are not “upper bracket”, however, the lack of real estate activity, when compared to last summer, was palpable.

There you go again with the Bush bashing Steven, isn’t there someone else to blame for your industry’s woes?

30 W Oak is a highly desirable building. It also looks like unit 19A is under contract. It was listed for $3.25M

It is a gorgeous building also, wish more buildings incorporated the water gardens into the street. Reminds me of most of the new buildings in Vancouver.

And to give Steve credit, wealthy people do very much like having money in hard assets that don’t get taxed on appreciation the same way and can’t be devalued in the same manner as cash has been.

“Renting is financial suicide. Purchasing a quality property is weatlh [sic] management…”

Perhaps if, for some reason, your rent were higher than taxes, insurance, and mortgage interest on a comparable property with appreciation close to zero. The recent increase in sales doesn’t imply an increase in prices; indeed, the article makes it clear that sales are on the rise because prices continue to fall. Moreover, inventory will remain once these folks have made their purchases, and the remainder of prospective buyers will demand even lower prices.

While this dead horse has been beaten mercilessly on this site, we can apply it to the “upper bracket” as well. They are indeed rational; they don’t all waste cash on housing just because they have it.

I wouldn’t call a super jumbo mortgage an asset – it’s a liability.

Gary – it seems like it is very difficult for people to trade down from their expected lifestyle or from their current lifestyle. i agree, its irrational, and probably one of the reasons the country is limping along as it is now, but its true.

fyi, another reason barrington is seeing a spike is because of the many new retail stores springing up in that area. i dont think simply the matter of price is enough to make a correlation w/ the expensive sales in chicago.

The over $1M sales numbers YOY comparisons are deceptive since a number of new luxury buildings did not begin closings until the 2nd half of 2007. Here are some buildings that are closing old contracts which distort reality: 1215 S Prairie, 450 Waterside, 600 N Fairbanks, 340 E Randolph, 160 E Illinois, 505 N McClurg.

The shills want you to believe that the increased closings represent new activity, when it clearly does not.

My comment pertains to the Chicago numbers.

If high end is selling like hot cakes why is my entire redfin search for south loop polluted by 1215 s prarie, 1201 s prairie, and 111 w wacker. Its a bloody PITA to scroll past 3 pages before you get to the real stuff…

What the article didn’t seem to address directly is what is happening to prices in the upper brackets.

i friend of mine sold her house in Hinsdale for $1,050,000 in 2005. Her buyers spent $250,000 in upgrades and recently sold it for $925,000. By my math that’s a $325,000 hit before you factor in commissions. I know this is anecdotal, but i can come up with 20 examples like this in the high end suburbs.

So while i think it’s a good sign there appears to be some increased activity, i don’t think it addresses what’s happening to prices. The article did seem to imply that people are waiting on the sidelines until they find deals. so maybe people are only buying “deals”, regardless of the price point.

In the end, we care more about prices than volume.

here’s some news from the other end of the spectrum, but I guess I am just a doom and gloomer, and this is not really happening, its just my imagination:

South Elgin targets neglected vacant homes

http://www.suburbanchicagonews.com/couriernews/news/1046344,3_1_EL09_A1VACANT_S1.article

sartre,

The various “New Urbanists” have been predicting for a while now that the starter home developments in the suburban fringe – very cheaply made, far from everything, or in other words, generally undesirable – will beget our society’s future slums, as accelerated by the foreclosure wave, collapse of property value and subsequently disintegration of the local tax base to support any upkeep. Eventually, out of necessity cities will allow landlords to acquire the properties and sub-divide them so the rental income can justify tax expense to support the city. The stuff around Elgin, Aurora, etc. seems to plausibly fit that description.

In contrast, the slums of the city, which will also get hit hard by the bursting bubble, are nonetheless -supposedly- sitting on fundamentally more desirable and valuable land given its accessibility, and thus have redevelopment/gentrification potential.

We’ll see. There will always be a market for nice suburbs (Barrington, North Shore, I-88 corridor) but the more marginal suburbs may be the biggest losers after all this shakes out (housing bubble, energy/transportation price increases, etc). At least within the city of Chicago, the wealthy areas will provide an adequately reliable tax base to absorb the blows to be received by the ghettos.

Either way, I wouldn’t want to be holding the deed for a house out in Sugar Grove, South Elgin, or Plainfield right now.

“Either way, I wouldn’t want to be holding the deed for a house out in Sugar Grove, South Elgin, or Plainfield right now.”

I haven’t looked up the rest, but South Elgin appears to be in an acceptable location and should recover when the housing bust clears (in a decade or more). It is awfully close to Schaumberg, which has enough corporate parks to support the surrounding suburbs. Similarly, I expect that the areas around Northbrook to do nicely, with all of the white-collar jobs there.

The exurbs that will be really killed are those far from *all* jobs.

Some might say that when the great depression II comes, the exurbs will be in the best position because they are closest to farm land so people can grow crops for subsistence. 😉

From WSJ today:

“Mortgage lenders and real-estate agents complain that insurers are painting the country with too broad a brush. For instance, the metropolitan area that includes Chicago, home to nearly eight million people, is designated a declining market by four of the top five insurers, even though home sales vary widely within the area.

“To put this blanket overlay on my marketplace and say it’s all a declining market, it’s not true,” says David Hanna, managing partner of Prudential SourceOne Realty in Chicago. City neighborhoods such as Lincoln Park and Hyde Park, as well as affluent suburbs such as Hinsdale, still are seeing home prices appreciate, he says.

Mr. Hanna points out the declining-market tag has hit such unlikely transactions as a $1.1 million sale of a home in Wilmette, a well-to-do suburb. The buyer had to come up with an extra 5% down payment.

In another case, a two-unit building in Chicago was ready to be sold to an investor for $449,000, when the required down payment again was boosted. The buyer still is trying to come up with the funds. It turned out that a different investor in that neighborhood had defaulted on seven properties, driving down comparable prices.

Mr. Hanna says such circumstances should be taken into account. “Maybe one project, because of past history, you have issues, but you’re impacting literally thousands of other people,” he says.

I do not agree with Hanna. I think he is just saying this to save his paycheck.

I think one thing that seems to be misunderstood here in most, but not all responses, is the nature of these purchases and who the buyers are. It’s been my experience that the buyers are not “trading up” and taking out jumbo, super jumbo or any loans for that matter. These are very wealthy people who are 1) very educated in housing cycles, 2) very, very wealthy(read-cash buyers) and as some have said, looking for a place to park a portion of their money. And 3)are eager to take advantage of situation that leans very heavily on their side.

These properties although extremely expensive are not being purchased at top dollar. Their being purchased at near bottom price points for the segment. There are numerous ‘never lived in’ resale’s available from speculators who purchased these unit pre-construction. Their business plan assumed a hearty 50-100% return on their minimal(5-10% down) pre-construction investment. Instead their having to close on these units and dump them with much less ROI.(most buildings such as 600 LSD have waived their no flip policy on their high end units since the investors who own them are regular customers of the developers various projects) Yes, they’re are still making good money(buy for $1.3 in ’04 sell for $1.8 in ’08. But when their business plan showed this property to be estimated at $2.5 in ’08 when they purchased, they’re not very pleased right now.

Then there’s the regular resale’s. High end sellers(really most all sellers in Chicago) who are currently listed for sale, for the most part, are not by choice. More than likely they have to sell for one reason or another. Thus they are having to take less than they would have had they sold when we were at the top of the cycle.(this is not a dollar for dollar figure but the expected market value if there were no highs or lows / for instance if condo was purchased for 100k 4 years ago and the next year it increased its value by 10% to $110k. But now 2 years later it will sell for that same amount- $110k-it’s the same figure as the top of market cycle but if the market would have stayed strong it would have been worth $130k today)

Because of this, regardless of the price point – most properties purchased today are a deal.

For the wealthy this is just another vehicle to invest their money. Live in it, rent it, leave it empty, or a place to crash when their in-town. Doesn’t matter to them. To them it’s all about buy low sell high. Nothing more nothing less.

BTW-I’m not wealthy so it’s as mind-blowing to me as it is to some of you, the amazing amount of money being spent-possibly on place that will never have the lights turned on until they sell it. But when one makes 5-10-20 million a year… a 2-3mil. condo is not a huge investment. And to really twist the knife on some of us ‘regular wage earners’ the average rental price is about $6-8,000 per month for 1-2mil condo and they rent almost immediately if they have lake views.

With 20% down -that almost pays the mortgage-if there were one!

Jeff,

I agree. The wealthy are not subject to the economic swings those in the

Jeff,

I agree. The wealthy are not subject to the economic swings those in the less than 3MM net worth club are.

About 13 years ago the average partner at a top NYC law firm earned seven figures and that was a big deal, I think for Chicago it was like 400k back then. I wouldn’t be surprised if this was seven figures for Chicago now. How many law and accounting partners are there at top tier Chicago law & accounting firms? My guess is around 5,000. How many want to live in the city? Lets say 2/3 as they can afford the ancillary life expenses. Add in the few WS jobs and the amount of old money in Chicago and the amount of old money from the midwest that moves here and I’d say there are at least 15k really wealthy people for Chicago. Most want to live in downtown.

Chicago does not have near the amount of old money wealth of NYC or even LA but it does draw from a huge geographic base. The midwest is pretty broad and the kids of entrepreneurs in Iowa eventually inherit that money at some point and some don’t want to hang around Des Moines nor does the NYC or LA scene appeal to them. They move to Chicago and more specifically downtown.

None of my suspicions are backed up with quantitative data but this is what I suspect because there is a lot of money in Chicago relative to the rest of the midwest. And I’m not talking about house rich Hoffman Estates power couples.

“I think one thing that seems to be misunderstood here in most, but not all responses, is the nature of these purchases and who the buyers are. It’s been my experience that the buyers are not “trading up” and taking out jumbo, super jumbo or any loans for that matter. These are very wealthy people who are 1) very educated in housing cycles, 2) very, very wealthy(read-cash buyers) and as some have said, looking for a place to park a portion of their money. And 3)are eager to take advantage of situation that leans very heavily on their side. ”

For every uber wealthy sophisticated all cash buyer I can show you a DINK couple taking on a jumbo interest only ARM loan. Chicago is not Dubai where wealthy investors are parking money in speculative real estate investments. Chicago, and especially its northside neighborhoods, are places where people live and work.

“Add in the few WS jobs and the amount of old money in Chicago and the amount of old money from the midwest that moves here and I’d say there are at least 15k really wealthy people for Chicago. Most want to live in downtown.”

I don’t agree. Take a drive around the north shore and tell me that most wealthy people want to live downtown. Downtown Chicago isn’t the upper west side. Again, please don’t confuse Chicago for Manhattan. These uber wealthy people are buying estates and compounds and very nice homes in the suburbs of the north shore, northwest suburbs (inverness anyone?) and areas of dupage county. They often have families and children and downtown can’t compete with the suburbs in that respect. I’m sure some super rich dudes buy condos for cash but that’s such a small niche market that I would hardly call them the “nature of these purchases.”

“I wouldn’t be surprised if this was seven figures for Chicago now. How many law and accounting partners are there at top tier Chicago law & accounting firms? My guess is around 5,000. How many want to live in the city? Lets say 2/3 as they can afford the ancillary life expenses.”

This is all demonstrably false. There are less than a dozen large law firms in Chicago with $1mm+ average profits. The most profitable Chicago-based firm has about 75 (real) partners in Chicago; most of the shops have an average constructed more like 10 at $600k and one at $5mm than everyone making $1mm.

Also, it’s at least 2/3 who live OUTSIDE the city. They live in Wilmette and Glencoe and Highland Park; they live in Hinsdale and Oak Brook. A few live in Naperville or Oak Park or Evanston. Most of them take the train most of the time.

One more thing–people tout real estate as a great investment because of the ease and extent of leveraging your capital. Hell, Stevo promotes interest-only purchasing. But now, we have other RE bulls saying that the rich don’t leverage AT ALL when buying investment properties. It can’t really be both–if leveraged real estate investing is actually such a great idea, then rich dudes would do it too. If all-cash is actually the best investment strategy, then leveraging (for us po’ folk) is a necessity rather than savvy investing.

All cash purchases for primary residences make no sense for the very wealthy. Believe it or not, people with a lot of money aren’t actually the best people to manage their own money.

And it’s not simply that leveraging your money in RE purchases is easy, it’s that your interest payments are tax deductible as well.

For the very wealthy, or even the pretty wealthy, you don’t get the full tax deduction of your interest. It starts phasing out surprisingly fast: starting at about $160K AGI, in fact (whether you are married or single). These types of buyers are not likely to benefit from the itemized deduction.

Kenworthey

“For the very wealthy, or even the pretty wealthy, you don’t get the full tax deduction of your interest. It starts phasing out surprisingly fast: starting at about $160K AGI, in fact (whether you are married or single). These types of buyers are not likely to benefit from the itemized deduction.”

The phase out is being phased out through 2010, after which it will disappear. Trust the IRS to make the tax code as complicated as possible. Still, its probably not a good idea to make real estate purchase decisions based on future tax impact, since the tax code could change dramatically in the near future.

Yes, J, phase out is phasing out… but those same very wealthy are likely subject to the Alternative Minimum Tax, and undoubtedly will still not benefit from the deduction. And, as you point out, who the hell knows what will happen with the tax code in the next few years. It would be too much to hope for the government to come to its senses and do away with the deduction altogether, like the rest of the world.

Good point Kenworthey- about the interest phase out. Most people aren’t aware of it. If you make over a certain income (and I think it IS about $150k or $160k) you start to “lose” these deductions (as well as other deductions.) You can no longer deduct all of the interest- for instance.

Also- as you point out- there is the Alternative Minimum Tax scenario as well.

The truly rich do NOT buy a property in order to get a tax deduction!

AMT does not affect the very wealthy – more like people in teh 200-400k bracket (that’s a rough estimtae from what I recall).