Dreaming of Your Albany Park Bungalow? 4501 N. Lawndale

Bungalows in some neighborhoods of the city are becoming more “affordable. ”

But what does that mean?

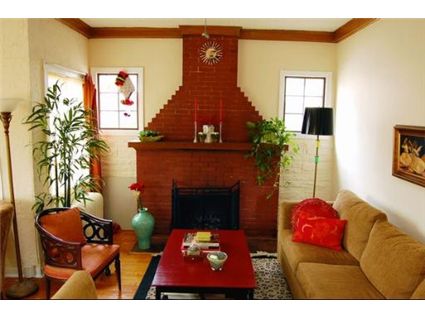

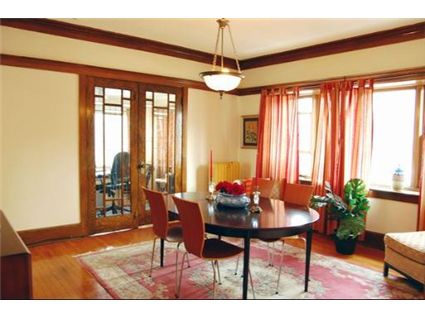

Take this 3-bedroom bungalow at 4501 N. Lawndale in Albany Park which was built in 1918. It still has many original features included french doors and a beamed ceiling.

Is it affordable at $350,000?

Here’s the listing:

Beautiful Craftsman style bungalow on 40ft-wide corner lot in Albany Park. Original features include brick WBFP, beamed ceilings, French Doors, leaded glass windows, pier mirror, moldings & plate rails.

Formal DR & refinished hdwd floors thru-out. New baths on main and lower level & new bsmt windows. Tear-off roof & circuit breakers in 2003. Privacy fenced backyard ideal for entertaining.

Re/Max Signature has the listing. See more pictures here.

4501 N. Lawndale: 3 bedrooms, 2 baths, basement, no square footage listed, 2 car garage

- Sold in March 1989 for $102,000

- Sold in May 1996 for $128,000

- Sold in May 1999 for $165,000

- Sold in May 2004 for $315,000

- Currently listed for $350,000

- Taxes of $5,110

- No central air

I wouldnt walk across the street to piss on their lawn. 350? ahahahaha

Yes, hd, I think this is too much for this house, in this location. sb $35k less than ’04, rather than $35k more, but that’s mainly about the location. It does have a nice 40′ lot.

Based on the taxes, is it currently a rental? Or is the owner ignorant of the homeowner exemption?

This kind of property would sell for about 120K in Fort Wayne. The taxes would be about $1100 a year.

are you serious, no way you would ever get this home for under 300k in albany park…wake up. clearly you are not in touch with current home prices in the area, this is a fairly good deal!

oh Sabrina, you had a nice string of super cool apts going.. and then you go and toss in a bungalow.

Yes yes! Give me more single family homes and bungalows and fee simple townhouses! I’m swearing off associations and this is just what I’m looking for. Unfortunately, it looks like the urban pioneers/hipsters have already gotten to this one. I want a dump without the cool furniture and refinished floors for about 100K less. Does anyone know much about crime in albany park? I’ve heard different things. Are there any major gang problems? Certain parts to avoid? I just met some gay guys who swear it’s the last relatively safe ‘hood on the north side where you can get a cheap single family fixer upper, but I’d love a second (and third) opinion.

One more thing…if b3 really thinks 350K is a good deal for a bungalow in Albany Park, I’d be more than happy to buy one of the many places that are currently listed there (and in Old Irving) for ~250K, fix it up, and put it back on the market for 350. Based on what else I see in the MLS right now, I don’t see how these sellers are going to get more than they paid in 2004.

I think this is a good deal and will sell quickly.

I think this is a good deal and will sell quickly.

Less than 1 mile from Kimball brown line stop-check. Less than 1.5 miles from Montrose blue line stop-check. Nice yard (!) – check. Nice construction/look.

Admittedly I don’t know the neighborhood well which could make all the difference, but it looks like a good deal.

Although the proximity to the el could be a factor in the winter this place seems priced right.

Keep it coming with the fee simples and sfhs around the city. I think you should also toss in some nice estate homes on the north shore and inverness just to mix things up. but anyway…

____________________________________________________________________

“are you serious, no way you would ever get this home for under 300k in albany park…wake up. clearly you are not in touch with current home prices in the area, this is a fairly good deal!”

If you think $350k is a good deal then just wait until next year. Prices will be even lower. A lot of the NW side neighborhoods (albany park, portage park, old irving, jefferson park) were subject to rampant MEW (mortgage equity withdraw). A side of effect of the MEW was rampant price increases. Or maybe it was the other way around. Anyway, this home went from $128k to $350k in 12 years. (I’ll let somebody else do the compound appreciation because math was never my strong point.) As a consequence of the MEW and higher home prices, there are now lots of foreclosures.

The banks are finally starting price some of the crappier bungalows in the $200’s which is something we haven’t seen in years. The used properties (non-reo’s) are priced in the $300’s, like this property, but if this property was put on the market in ’06 or ’07 the asking price would have easily reached the $400’s. Prices are generally trending lower and more affordable. It’s just a matter of time before places like this head into the mid to upper $200’s. This house may sell in the $300’s but in a year or two the comps will be even lower. Mark my words.

There are a handful of bungalows in old irving and the villa that I’ve been keeping my eye on…they’re currently priced in the $400’s and $500’s with little or no price reductions….and let’s just say they’ve been sitting for a long, long time. My jerk off neighbor bought a rundown bungalow in ’05 for $450ish in old irving as an investment and it virtually set the comps for the entire neighborhood. Few if any bungalows have sold since…but many have been put on the market. The first one finally listed below $400 the other day – it listed for $379k.

From ’89 to ’04, it’s about 7.8% annual increases. The ask is a little under 2.7%/yr since ’04. 5%/year since ’89 gives a price of $257k. So, I’d stick with my off the cuff $280k as a good price for it, based on non-bubble era pricing. This isn’t a neighborhood that has changed enough to justify a meaningful premium over historical pricing (although, the big lot makes it appealing as a future redevelopment).

I’ve been looking for a single family in the area. Unfortunately there is some gang activity around Montrose and Lawndale (check the chicago police department website). If you are going to do Albany Park you are better off closer to Ravenswood(east), Old Irving/Jefferson Park (west) or north of Lawrence. I almost put an offer this summer on a corner lot bungalow one block east on Monticello until I looked at the crime report and saw there had been a murder on the street that week. One of my Chicago cop friends also warned me about some of the gang activity. Chicagogangs.org shows you “territories” all over the city. I think Familia Stones is the biggest one however Lawndale is the border line with a number of smaller groups who are all moving for position along Montrose. There are some beautiful places and a fair amount of families however you just have to understand its not Lincoln Park and then decide if 350 is still worth it.

Sold for 325k (recorded 12/1/08)

’04 buyer lost money, about in line with what C-S data says (SFH @ nominal ’04 levels)

We’ll have to wait for another property to test HD’s prediction about prices in 09

$325k? Not bad…back at ’04 pricing. Any prognosticators among us want to call a bottom??

I’m going to go out on a limb here and predict that the comps over the next six months will probably chop another $25k off the $325k selling price…and then six months after that another $15k or $20k and so on and so on. All the way back to ’00 or even ’99 pricing.

My estimates are conservative too – there’s an increasing number of people on these tubes who think we’ll overshoot into ’97 and even ’96 territory as the recession accelerates into a depression….And no I’m not happy the economy is doing so terrible but the silver lining is more affordable housing for everyone…or at least those can choose to sit on the sidelines during the mania…

Thanks for the update on this property.

We’re seeing 2004-2005 prices just about everywhere now.

“there’s an increasing number of people on these tubes who think we’ll overshoot into ‘97 and even ‘96 territory as the recession accelerates into a depression”

Who, exactly, are “people on these tubes” and why should anyone take them, or you, seriously?

And why should I take you seriously?

Should we take you seriously because your name is Turd?

I think the simplest answer why prices are going to ’99 or ’00 is because the market is reverting to pre-bubble prices of which there is a consensus (at least among those who admit there was a bubble) is 1999 or 2000. The “people on these tubes” argue that prices will overshoot pre-bubble prices in a reversion to the mean which means 1996 or 1997 prices. I think both arguments have merit but I tend to estimate conservatively.

What specific economic factors will cause housing declines to return to 2000 prices? There are many reasons, including:

1) The infamous arm reset chart shows billions in resets until 2013;

2) foreclosure are accelerating;

3) foreclosure prices are often much cheaper than existing sales;

4) 70% of all foreclosure have yet to be listed on the market;

5) tight credit;

6) government invention will prolong the correction;

7) Jingle keys;

8) inventory in the pipeline is still high;

9) unsold inventory is still extremely high;

10) unemployment is rising;

11) the economy is contracting;

12) the threat of deflation is looming;

13) larger down payments and good credit require for mortgages;

14) in some areas 1 out 5 people are underwater;

15) housing sales volume continues to slide lower;

16) default rates among option arms are estimated to be 60% or more;

IMHO the market will have turned a corner when a majority of the above threats have abated. If you have a better argument, lay it out. We can argue like adults. You don’t need to be such a bitter vitriol a$$ to people.

HD,

I think mid-90s pricing is a little far fetched at this point. Right now you can get a nice SFH in LP for around 725k.

Hate to agree with StevO but if this falls much further I will be a buyer within 5 years time.

Good ‘hoods will have a bottom before the crap hoods that were overinflated do. A SFH in LP for 725k seems okay compared to crapbox condos in Lincoln Square or Rogers Park for 450k+! LOL.

One ‘hood is established and the other is a bunch of stuck posers counting on RE appreciation to support their lifestyle and family plan. I think we know which hoods are going down the drain vs. staying afloat.

Stay away from condo intensive neighborhoods like Lincoln Square or Rogers Park where every early 30 something who wanted to be “seen” invested in RE. LOL! Let the default and fail in life.

Err Rogers Park should’ve read Roscoe Village. Sorry for the confusion.

Funny… prices looked good in Cali “compared” to previous prices but yet still keep going down.

Turd.. markets always overshoot the mean reversion point. If it didn’t the mean would have to move up for it to be overshot or it could never be the mean. Kinda has to happen by definition of a mean.

Math is fun.

“a reversion to the mean which means 1996 or 1997 prices”

HD: If prices are “reverting to the mean”, it’s better to talk about real dollars, not nominal dollars. Are these unnamed “them” predicting ’97 real prices or ’97 nominal prices? ’97 real prices seems a possibility on an overshoot, 97 nominal price–housing will remain very, very unaffordable, b/c no one will be able to get financing, no one will be moving, banks will have to hire management companies to rent their worthless (but cashflowing!!) REO inventory.

It makes a **huge** difference b/c $100k in 97 = $132k in ’08 and that spread will (likely) continue to grow. Doing a real analysis using nominal prices leads to (possibly) deceptive conclusions.

I’m not the one arguing for ’97 prices. I’ve argued a hybrid of nominal and real 1999 prices which provides me with enough leeway because predicting these things with accuracy is fuzzy by nature.

“I’m not the one arguing for ‘97 prices.”

I know. I’m asking what “they” are saying, since you don’t provide a link or a name–so I can’t find out myself.

If “they” are saying 1997 real prices, “they” are predicting something pretty close to 99-00-01 nominal prices (depending on teh market), so they agree with you, sort of. If it’s ’97 nominal prices, “they” are (effectively) predicting massive deflation in a very, very inflationary monetary environment.

It’s not an inflationary environment anymore. We’re entering a deflationary environment. The government cannot print money or spend money fast enough to offset the destruction and cancellation of money happening right now. Japan had numerous stimulus plans after it’s run up in the 80’s and it couldn’t print enough money.

Everything is getting cheaper right now. Even health care inflation is easing…housing, food, commodities, imported goods – all cheaper.

” Japan had numerous stimulus plans ”

Which one lead to anyone spending a dime? Wasn’t the problem that the banks used their piece to sit on their zombie assets and the public used their piece to save even more?

anon(tfo) as much as I want to continue the deflation/inflation argument right now, I cannot, i’ve got a million things to do and i’m stressed beyond belief right now – we’ll pick up the discussion at a later point in time!

Ok i’ finished my brief i need to file before 4:30 p.m.

Tips yields today are signaling the death of deflation….who knows what’s going happen, just hedge your bets!

hd,

TIPS yields aren’t as reliable an indicator as they may seem. There are numerous restrictions on who/what institution can purchase them and they aren’t nearly as liquid a market as vanilla treasuries.

Also the credit markets are so c_cked up that its hard to read the tea leaves from indicators that used to work in my view.